ATTOM Data Solutions, Irvine, Calif., released its February U.S. Foreclosure Market Report, showing 11,281 U.S. properties with foreclosure filings— up 16 percent from a month ago but down 77 percent from a year ago.

Category: News and Trends

Work-From-Home Movement Pressures Office Properties

The central business district shutdowns that began just over a year ago dramatically increased remote working and pressure on office properties, said Fitch Ratings, New York.

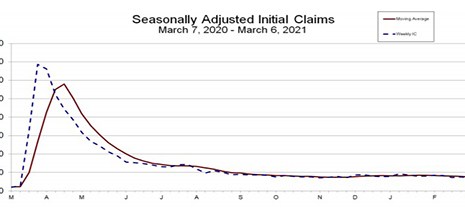

Unemployment Claims Fall to Near Post-Pandemic Low

Initial claims for unemployment insurance fell by 42,000 to their lowest level since November, the Labor Department reported yesterday, nearly matching a post-pandemic low.

Report: AI, Algorithmic Lending Can Reduce Mortgage Lending Racial Disparities

Artificial intelligence and algorithmic lending can help reduce racial disparities in mortgage lending, a new report from the Financial Services Innovation Coalition and Creative Investment Research found.

Industry Briefs Mar. 12, 2021

HUD approved a Conciliation Agreement between JPMorgan Chase Bank and a Black woman, resolving the woman’s claim that the mortgage lender, relying on an appraisal that she believed was inaccurate, valued her home at an amount lower than its actual worth because of her race.

Dealmaker: Avison Young Closes $17M in Office, Retail Asset Sales

Avison Young’s Florida Capital Markets Group closed $17.2 million in property sales in Weston, Fla.

People in the News Mar. 12 2021

ClosingCorp, San Diego, appointed Christine (“Chris”) Boring as chief product officer, responsible for defining and executing the company’s product vision and strategy and leading product development and implementation efforts.

House Gives Final Approval to $1.9 Trillion Stimulus Package

The House on Wednesday approved a $1.9 trillion economic stimulus package, giving the Biden Administration a key legislative victory and providing relief to millions of Americans affected by the coronavirus pandemic. President Biden signed the bill into law on Thursday.

Quote

“Development and deployment of artificial intelligence and algorithmic lending systems, paired with the increase in lending from non-banks, can make significant progress in allowing disadvantaged populations–specifically Black Americans–obtain housing loans, a critical component to generational wealth.”

–Kevin Kimble, Founder & CEO of the Financial Services Innovation Coalition.

Construction Loan Considerations During the COVID-19 Pandemic

Construction lending calls for a high degree of perseverance and accuracy to mitigate its inherent risks. The COVID-19 pandemic has made business much more difficult and complex.