Freddie Mac, McLean, Va., said its Apartment Investment Market Index remained positive in the fourth quarter despite contractions in several major metros.

Category: News and Trends

Michael Barone and Scott Weintraub: The New 1003 and Mortgage March Madness

Unlike the NCAA basketball tournament, March Madness in the mortgage industry began very early in March and will last beyond the NCAA Championship game on April 5. By adjusting their application best practices and keeping a keen eye out for upsets for the next few months, lenders can stop upsets before they happen and avoid a busted bracket.

Multifamily Market Musings: Q&A with MBA’s Sharon Walker

MBA NewsLink interviewed MBA Associate Vice President of Commercial/Multifamily Sharon Walker, who represents MBA members active in multifamily finance. She advocates on policy issues primarily related to Fannie Mae, Freddie Mac and the Federal Housing Administration and oversees numerous related committees, working groups, councils and events.

(Switching Gears) Nate Johnson: Will You Be Able to Transition Staff When the Market Shifts?

Are we looking at a downturn? Yes, but in my view, it’s not going to be significant enough to see a huge migration of people out of the mortgage industry. It will, however, require every organization to think hard about how to best use their personnel resources to come out ahead.

Quote

“This is the strongest seller’s market since at least 2006. Buyers outnumber sellers by such a huge margin that many homeowners are staying put because they know how hard it would be to find a place to move to. It seems like the only move-up buyers who are confident enough to list their homes are those who are relocating to a more affordable area where they’ll have an edge on the local competition.”

–Redfin Chief Economist Daryl Fairweather.

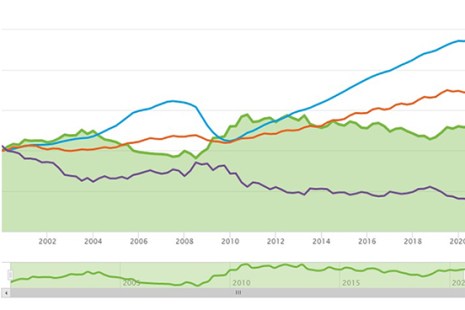

MBA RIHA Study: Affordability Growing Challenge for Low-, Moderate-Income Renters in Majority of Top 50 Metro Areas

Home prices and rent appreciation have exceeded income growth since the turn of the 21st century. This has created economic obstacles for many American households, especially for low- and moderate-income renters living in cities with recent employment growth but significant housing supply constraints, according to a new report from the MBA Research Institute for Housing America.

Lori Brewer: Lender Staffing Data Signals Need to Automate Back Office and Monitor Performance

Lenders hiring their way through spikes in volume, as they have for decades, is a suboptimal, efficiency-draining reaction — not a strategic business decision. Any time lenders hire to manage temporary spikes in volume they reduce profitability, add enterprise risk and pour valuable internal resources into a hiring-firing routine that can destabilize and discourage an entire organization long after volume has normalized.

JLL, CBRE, KeyBank Lead MBA 2020 Commercial/Multifamily Originators

The Mortgage Bankers Association this week released its 2020 Rankings of Commercial/Multifamily Mortgage Firms by origination volumes. The report said JLL, CBRE and KeyBank led commercial/multifamily overall rankings.

Alan Parris: Using Digital Marketing to Build Relationships with the Next Big Home Buyer Generation

Today’s customers live online and expect relevant, personalized content and messaging that resonates with their individual wants and needs. That leaves plenty of opportunity for lenders to connect with this massive cohort by providing value and education.

Distressed Debt Monitor: CBRE’s Patrick Connell on the Role of Receiverships

2021 and beyond looks to be a marketplace defined by haves and have-nots with significant property type performance divergence both within and across property types. MBA Newslink interviewed CBRE’s Patrick Connell for some perspective on downturns and the role receiverships play in navigating the path to recovery.