With the benchmark 30-year fixed rate beginning to creep higher, however, we may start to face a new reality. That’s why smart originators are already thinking about how to generate business when the refi dust settles. And many are setting their sights on the real estate investor channel, because the opportunities for business growth are incredible.

Category: News and Trends

MBA Urges Treasury, FHFA to Reconsider GSE Purchase Caps

The Mortgage Bankers Association on Monday asked for a meeting with Treasury and Federal Housing Finance Agency officials to address MBA member concerns over newly imposed limits on government-sponsored enterprise operations that could cause potential disruptions to the housing finance system.

Multifamily Market Musings: Q&A with MBA’s Sharon Walker

MBA NewsLink interviewed MBA Associate Vice President of Commercial/Multifamily Sharon Walker, who represents MBA members active in multifamily finance. She advocates on policy issues primarily related to Fannie Mae, Freddie Mac and the Federal Housing Administration and oversees numerous related committees, working groups, councils and events.

Alan Parris: Using Digital Marketing to Build Relationships with the Next Big Home Buyer Generation

Today’s customers live online and expect relevant, personalized content and messaging that resonates with their individual wants and needs. That leaves plenty of opportunity for lenders to connect with this massive cohort by providing value and education.

Michael Barone and Scott Weintraub: The New 1003 and Mortgage March Madness

Unlike the NCAA basketball tournament, March Madness in the mortgage industry began very early in March and will last beyond the NCAA Championship game on April 5. By adjusting their application best practices and keeping a keen eye out for upsets for the next few months, lenders can stop upsets before they happen and avoid a busted bracket.

MBA Urges Treasury, FHFA to Reconsider GSE Purchase Caps

The Mortgage Bankers Association on Monday asked for a meeting with Treasury and Federal Housing Finance Agency officials to address MBA member concerns over newly imposed limits on government-sponsored enterprise operations that could cause potential disruptions to the housing finance system.

MBA Urges Treasury, FHFA to Reconsider GSE Purchase Caps

The Mortgage Bankers Association on Monday asked for a meeting with Treasury and Federal Housing Finance Agency officials to address MBA member concerns over newly imposed limits on government-sponsored enterprise operations that could cause potential disruptions to the housing finance system.

In Bidding Wars, Cash—Especially All-Cash—is King

With more than half of home sales in many U.S. markets seeing multiple offers, one strategy seems to be working in winning the bidding war—cold, hard cash.

February Existing Home Sales Drop 6.6%

Existing home sales declined in February, following two prior months of gains, the National Association of Realtors reported yesterday.

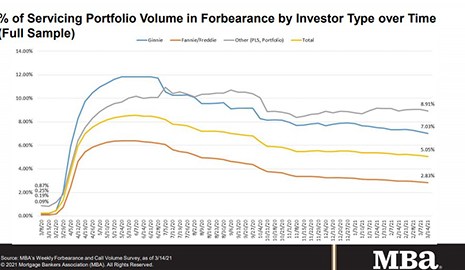

MBA: Share of Loans in Forbearance Falls to 5.05%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance fell by 9 percent to 5.05% of mortgage servicers’ portfolio volume as of March 14 from 5.14% the week earlier–the lowest level in nearly a year. MBA estimates 2.5 million homeowners are in forbearance plans.