The Mortgage Bankers Association’s Spring Summit is less than three weeks away. Four conferences in one – designed for the times – MBA’s all-new Spring Conference & Expo: Independent Mortgage Banks, Secondary Markets, Servicing and Technology is your opportunity to get everything you look forward to at your favorite MBA event, plus even more content and connections.

Category: News and Trends

Brian Lynch: A Deeper Dive into Mortgage Accounting: Financial Reporting is More Important Than Ever Before

Loan officers, branch managers, c-level executives and more need access to granular financial data and in-depth accounting tools in a changing market. The pandemic rapidly spurred the adoption of tech solutions and heightened the industry’s reliance on technology – from helping lenders operate, to supporting loan officers in their day-to-day tasks, to increasing daily efficiencies for the accounting department.

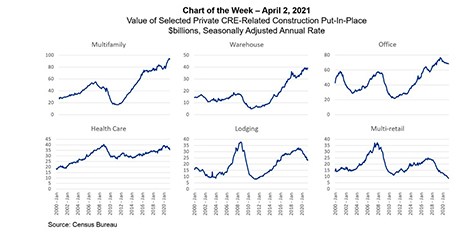

MBA Chart of the Week Apr. 5, 2021: Value of CRE Construction

One of the most striking aspects of the COVID-19 pandemic’s impact on commercial and multifamily real estate has been the disparity in the ways different property types have been affected. MBA’s monthly CREF Loan Performance Survey continues to show the immediate and dramatic rise in delinquency rates among lodging and retail properties.

MBA Advocacy Update Apr. 5, 2021

On Wednesday, President Joe Biden unveiled a $2.3 trillion infrastructure proposal known as the American Jobs Plan, which centers on investing in infrastructure, affordable housing, and green energy – and employs tax policy changes to partially fund the ambitious set of proposed initiatives. On Thursday, the U.S. Supreme Court issued its opinion in Facebook v. Duguid, a dispute concerning the scope of the TCPA’s automatic telephone dialing system definition.

Dealmaker: NorthMarq Arranges $92M for Multifamily

NorthMarq arranged $92 million in financing for multifamily properties in Arizona and Minnesota.

SCOTUS Ruling Supports MBA Interpretation of TCPA ‘Autodialer’ Definition

The U.S. Supreme Court unanimously ruled Thursday that a statutory definition of what constitutes an “autodialer” was overly broad, giving Facebook and a number of businesses, including the Mortgage Bankers Association, a decisive legal victory.

Quote

“We fully expect that this pace of job gains will continue for months, and anticipate that the unemployment rate, now at 6 percent, will be well below 5 percent by the end of the year.”

–Mike Fratantoni, Chief Economist with the Mortgage Bankers Association.

MBA Seeks Nominations to Serve on COMBOG

The Mortgage Bankers Association’s Commercial Real Estate/Multifamily Finance Board of Governors (COMBOG) Nominating Committee seeks members’ recommendations for individuals to serve on the Board beginning this October in the Investor, Lender, Mortgage Banker and Servicer categories.

Jennifer Henry: How Cloud-Based Solutions are Powering the Digital Mortgage Transformation

Cloud computing allows the mortgage ecosystem to no longer be as segmented but rather, exist in a more holistic environment of insights and solutions that deliver a seamless digital experience. Mortgage professionals are already leveraging cloud technology to make smarter, more informed decisions.

Industry Briefs Apr. 5, 2021

Auction.com, Irvine, Calif., released its 2021 Seller Strategy Report, based on an analysis of more than 70,000 properties brought to foreclosure auction on the Auction.com platform in the four quarters ending in Q1 2021.