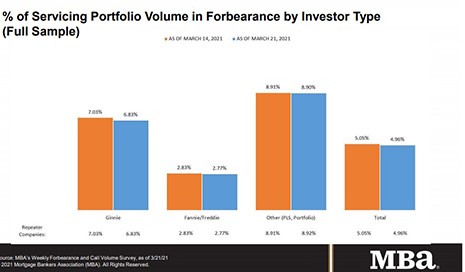

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 9 basis points to 4.96% of servicers’ portfolio volume as of March 21 from 5.05% the week before. This marks the fourth consecutive week of decreases. MBA estimates 2.5 million homeowners are in forbearance plans.

Category: News and Trends

Industry Briefs Mar. 30, 2021

Embrace Home Loans, Lehi, Utah, announced plans to roll out SimpleNexus, a homeownership platform for loan officers, borrowers, real estate agents and settlement agents, to more than 300 retail mortgage LOs before the end of the year.

Jerry Schiano of Spring EQ: The Outlook for Home Equity Lending

Jerry Schiano is CEO of Spring EQ, Philadelphia, a nationwide refinance, home equity and HELOC lender.

Dealmaker: Bellwether Enterprise Closes $59M for Austin Affordable Multifamily

Bellwether Enterprise Real Estate Capital LLC, Cleveland, closed a $59 million Fannie Mae Multifamily Affordable Housing loan deal to acquire Broadstone 8 One Hundred, located at 8100 Anderson Mill Road in Austin, Texas.

CRE Investors Show Increased Appetite for Risk

CBRE, Dallas, said commercial real estate investors are showing a clear shift in risk tolerance–and a new preference for secondary markets.

mPact’s Commercial Production Advisory Council Welcomes Maggie Burke as Chair

The Mortgage Bankers Association’s young professional’s group, mPact, welcomes a new chair this month for the Commercial Production Advisory Council, Berkadia’s Maggie Burke.

Top 5 Things You Should Know About Being iLAD-Ready

MISMO, the industry’s standards organization, developed iLAD through close collaboration across the industry, including with lenders, vendors, IT companies and GSEs. The MISMO Loan Application Data Exchange (LADE) Development Work Group is working to ensure these iLAD specifications will continue to evolve to meet industry needs.

Capital of Consequence: Bridge Lending is Trending

Bridge lending remains an active piece of the commercial real estate finance pie heading into the anticipated economic recovery in the second half of 2021. These products and the large number of institutions offering them to sponsors are defining features of an economy in transition.

MISMO Seeks Member Comment on Enhanced Logical Data Dictionary

MISMO® announced it is seeking member comment on its Enhanced Logical Data Dictionary (ELDD) for a 60-day comment period.

Troy Baars: Market Volatility Drives the Need for Speed in GNMA Spec Pool Formation

While there is a tremendous benefit to adding Ginnie Mae specified (spec) pools as part of a diversified execution strategy, lenders cannot continue to operate as if it’s business as usual when faced with the current volatility in the mortgage-backed securities market. Instead, speed must become of the essence, and lenders need to move as quickly as possible while monitoring the MBS market closely to continue effectively utilizing this strategy and maximize their secondary profitability.