The hospitality debt market is showing a resurgence as the lodging industry continues to recover, said JLL, Chicago.

Category: News and Trends

Quote

“MBA commends Secretary Fudge for maintaining FHA’s current mortgage insurance premium pricing until we have a clearer picture of the long-term impact of the pandemic on FHA borrowers and the insurance fund. While it is desirable to have lower mortgage financing costs, particularly as rates rise and home prices continue to increase, we agree with HUD that we need more data about how the more than 1 million FHA loans that are delinquent perform as they exit COVID-19-related forbearance. We look forward to continuing to work with Secretary Fudge on ways to protect FHA borrowers and ensure the overall stability of the FHA program.”

–MBA President & CEO Robert Broeksmit, CMB, in response to comments by HUD Secretary Marcia Fudge on the status of the FHA Mutual Mortgage Insurance Fund.

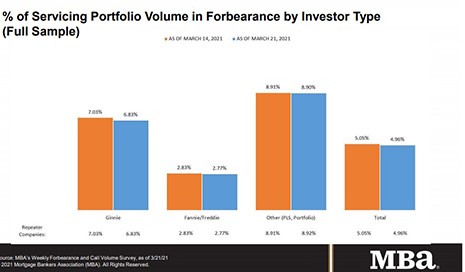

MBA: Share of Loans in Forbearance Hit New Pandemic Low

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 9 basis points to 4.96% of servicers’ portfolio volume as of March 21 from 5.05% the week before. This marks the fourth consecutive week of decreases. MBA estimates 2.5 million homeowners are in forbearance plans.

Industry Briefs Mar. 31, 2021

Embrace Home Loans, Lehi, Utah, announced plans to roll out SimpleNexus, a homeownership platform for loan officers, borrowers, real estate agents and settlement agents, to more than 300 retail mortgage LOs before the end of the year.

Jerry Schiano of Spring EQ: The Outlook for Home Equity Lending

Jerry Schiano is CEO of Spring EQ, Philadelphia, a nationwide refinance, home equity and HELOC lender.

People in the News Mar. 31, 2021

Auction.com, Irvine, Calif., promoted Ali Haralson to president, a new position in the company that will oversee both sales and operations.

mPact’s Commercial Production Advisory Council Welcomes Maggie Burke as Chair

The Mortgage Bankers Association’s young professional’s group, mPact, welcomes a new chair this month for the Commercial Production Advisory Council, Berkadia’s Maggie Burke.

Top 5 Things You Should Know About Being iLAD-Ready

MISMO, the industry’s standards organization, developed iLAD through close collaboration across the industry, including with lenders, vendors, IT companies and GSEs. The MISMO Loan Application Data Exchange (LADE) Development Work Group is working to ensure these iLAD specifications will continue to evolve to meet industry needs.

Troy Baars: Market Volatility Drives the Need for Speed in GNMA Spec Pool Formation

While there is a tremendous benefit to adding Ginnie Mae specified (spec) pools as part of a diversified execution strategy, lenders cannot continue to operate as if it’s business as usual when faced with the current volatility in the mortgage-backed securities market. Instead, speed must become of the essence, and lenders need to move as quickly as possible while monitoring the MBS market closely to continue effectively utilizing this strategy and maximize their secondary profitability.

CDC Extends National Eviction Moratorium to June 30

The Centers for Disease Control and Prevention announced yesterday an extension to the eviction moratorium further preventing the eviction of tenants who are unable to make rental payments. The moratorium that was scheduled to expire on March 31 is now extended through June 30.