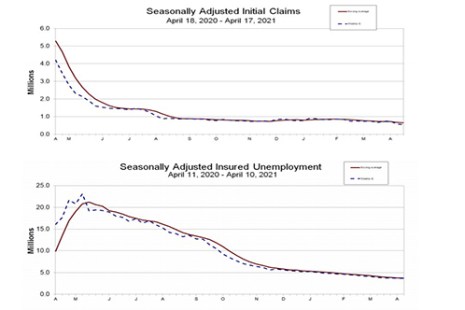

Initial claims fell to their lowest level since March 2020, the second-straight week of dramatic drops, the Labor Department reported yesterday.

Category: News and Trends

Existing Home Sales Fall 2nd Straight Month Amid Record-High Prices

Existing home sales fell in March, marking two consecutive months of declines, the National Association of Realtors reported yesterday, even as the market saw record-high home prices and gains.

#MBASPRING21: The Future of The Workplace

The office has evolved over past decades, but the pandemic greatly increased how–and how fast–offices are changing, New York Times columnist and CBS Sunday Morning Contributor David Pogue said during the Mortgage Bankers Association’s Spring Conference & Expo 21.

#MBASPRING21: MBA Forecasts 2021 Purchase Originations on Pace to Record $1.67 Trillion

The Mortgage Bankers Association’s updated Economic Forecast projects 2021 purchase originations are on track to grow by 16.4% to a record $1.67 trillion.

MBA NewsLink Tech All-Star 2021: A Passion for Safe Closes—Ike Suri, Chairman & CEO, FundingShield

You might say Ike Suri is feeling the love these days. The quality of his vision in the past four years has transformed how many of us work. Plus, it’s hard to ignore the head of a company that has reviewed more than $1 trillion (that’s trillion with a “t”) in closing value.

Dealmaker: Capital One Closes $61M in Freddie Mac Loans

Capital One, Bethesda, Md., provided $61.3 million in Freddie Mac loans for the acquisition of two Colorado Springs, Colo., apartment communities.

#MBASPRING21 HUD Secretary Fudge Talks COVID, Infrastructure, Enforcement

A little more than a month ago, Rep. Marcia Fudge, D-Ohio, voted “yes” to approve the American Rescue Plan, a nearly $2 trillion initiative by the Biden Administration to support the economy. Now, as HUD Secretary, it’s her job to put key provisions of the legislation into action.

#MBASPRING21 Andre Perry: Don’t Recycle Discrimination

Brookings Institution Senior Fellow Andre Perry says Black-owned homes are “systemically undervalued,” with obvious adverse consequences for wealth accumulation. And he has some ideas about what can be done.

Quote

“Refinance volume has already trailed off because of the steep climb in mortgage rates since January. Mortgage lenders should continue to prepare for the transition to a strong purchase market and slowing refinance activity.”

–MBA Chief Economist Mike Fratantoni.

(The New Normal) Garth Graham: Shifting Teams at the Speed of a Pandemic

Between stay-at-home orders, historical levels of refinance activity and the big increase in forbearance requests, mortgage originators and servicers spent the past year continually creating and re-creating ways to get things done. Here’s some of the things we saw.