CBRE, Dallas, closed $38.6 million in office sector transactions in southern California.

Category: News and Trends

Mortgage Loan Compensation Report Shows Increase in Commissions Despite Drop in BPs Paid

LBA Ware, Macon, Ga., said its analysis of first quarter mortgage industry loan compensation showed increases in year-over-year refinance and purchase loan volume contributed to higher overall commissions for loan originators and loan processors despite a slight decline in basis points paid per loan.

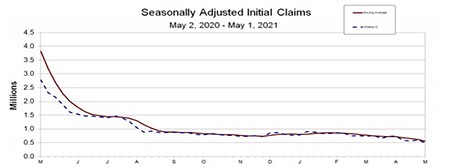

Initial Claims Drop Under 500K

Initial claims for unemployment insurance fell to under 500,000 for the first time in more than a year, a further indication ahead of this morning’s employment report that the nation’s economic recovery—and rapid jobs creation—continue to gain steam.

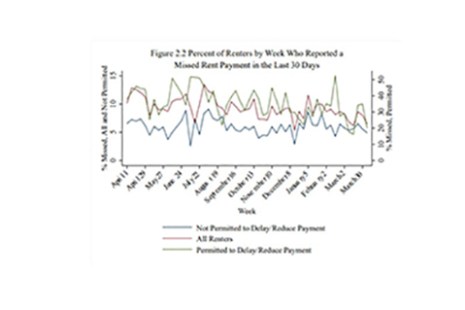

RIHA: Less Than 10% of Homeowners, Renters Have Missed Multiple Payments During Pandemic

Slightly under five million households did not make their rent or mortgage payments in March, an improvement from December 2020 and the lowest number since the onset of the COVID-19 pandemic, new research from the Mortgage Bankers Association’s Research Institute for Housing America reported.

MBA CONVERGENCE Holds Memphis Job Fair, Homebuyer Fair

The Mortgage Bankers Association’s affordable housing initiative, CONVERGENCE, recently held virtual events in Memphis, Tenn., for area jobseekers and potential home buyers.

Michael Miller: Bridging the Digital Divide of People, Process & Technology

Bill Belichick, one of the most successful coaches in professional football history, once said a team is “not the strength of the individual players, but it is the strength of the unit and how they all function together.” Such wisdom surely resonates with many business leaders in our industry. But how well do they live by it?

CMBS Market Musings: Trophy Asset and Transitional Loan Transactions Thrive

The private-label CMBS market remains a mixed bag showing signs of a K-shaped recovery in the second quarter with delinquency and default numbers trending down now for nine consecutive months.

Joe Murin: Does Limited Housing Inventory Mean the Beginning of the End of Housing Boom…or End of the Beginning?

Soaring home prices and raging demand will not be enough to slow the housing train. In fact, they may actually help it.

Tai Christensen of CBC Mortgage Agency: Black Homeowner Equity Takes Big Step in Right Direction

Tai Christensen is the Diversity, Equity and Inclusion Officer and the Director of Government Affairs for CBC Mortgage Agency, a national down payment assistance provider, and has 17 years of experience in the mortgage industry.

Cam Melchiorre: Rapid Rental Relief: The Problem and The Solution

It is imperative for technology providers to help navigate the way through the process that could, if not addressed, destabilize the housing industry.