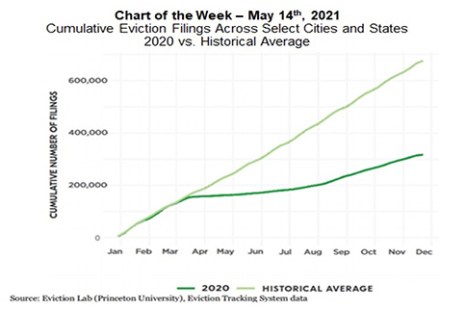

On Wednesday, May 5, U.S. District Court Judge Dabney Friedrich issued an order vacating the U.S. Centers for Disease Control and Prevention’s national eviction moratorium. But with the number of Covid-19 cases, hospitalizations and deaths falling, increased attention is being paid to when, and how, to allow the various moratoriums to phase-out.

Category: News and Trends

Survey Shows ‘Momentous’ Surge in Technology Adoption

The coronavirus pandemic has permanently changed the way consumers use technology and those looking to buy or refinance a home are seeking lenders who offer online tools to complete their mortgage loans from home, according to ICE Mortgage Technology, Pleasanton, Calif.

The Week Ahead—May 17, 2021

Good morning! And welcome to the start of a busy two weeks of important housing reports.

Q&A with Gene Ludwig of Promontory MortgagePath

Gene Ludwig is founder of the Promontory family of companies and CEO of Promontory MortgagePath, a technology-based mortgage fulfillment and solutions company. He is also managing partner of Canapi, a venture capital firm focused on investments in early to growth-stage fintech companies. He was Comptroller of the Currency under President Bill Clinton.

Quote

“Last year brought our industry a perfect storm. You not only had COVID, which required lenders to shift to virtual workforces, but you also had to conduct business in a safe and socially distanced way with borrowers; at the same time we were experiencing a historical increase in loan volume…We heard many stories from our lenders across the country that had to completely and permanently shift the way they served borrowers.”

–Joe Tyrrell, President of ICE Mortgage Technology.

MBA Opens Doors Foundation Surpasses 7,000 Families Helped with $10.3 Million in Grants During 10-Year Anniversary

The MBA Opens Doors Foundation announced it has now provided more than $10.3 million in rental and mortgage payment grants to more than 7,000 families.

(The New Normal) Jane Mason: With Right Technology, Servicers Proved Remote Teams Can Excel

Mortgage servicing has certainly seen ups and downs over the years, although nothing compares to the level of upheaval that we saw last year—nor the speed at which it occurred. Out of the chaos, however, new opportunities to excel have emerged, and perhaps the biggest one of all has been the ability to run a remote workforce with success.

Bob Mansur, CMB, AMP: Your Actions When Your LOs Won’t Do It?

Our three previous articles made the argument for behavioral standards, how to set those expectations, and a valuable response to an LO’s efforts to meet your requirements. Those presentations assumed LOs are willing to change their actions to deliver required results. In this part we address how you might effectively respond when an underperforming LO lacks the motivation to make those changes.

People in the News May 17, 2021

The Mortgage Bankers Association presented its annual Burton C. Wood Legislative Service Award to John Fleming, Counsel of the Law Offices of John Fleming, and General Counsel of the Texas Mortgage Bankers Association.

Mark P. Dangelo: Accelerating ‘as a Service’ (aaS) Displaces Finance and Lending Traditions

The plethora of aaS over the past decade has within their silos been nothing short of a disruptive phase shift of hardware, network, data, and software consumption. However, what happens when these aaS offerings are merged, stacked, and branched to arrive at containers of agility and innovation all serving rapidly evolving customers and their expectations of how finance should be conducted?