The Mortgage Bankers Association, in a May 19 letter, asked the Consumer Financial Protection Bureau to delay the effective date of its final rule amending the Fair Debt Collection Practices Act.

Category: News and Trends

Industry Briefs May 21, 2021

Quicken Loans, Detroit, announced it will officially change its name to Rocket Mortgage on July 31. This change will bring alignment to the overall “Rocket” brand.

Omar Jordan of LenderClose on the Evolving Home Equity Loan Market

Omar Jordan is Founder and CEO of LenderClose, West Des Moines, Iowa, a fintech that equips loan originators with the workflows needed to boost efficiencies and shorten the lending cycle through streamlined and meaningful integrations. He founded LenderClose in 2015.

Dealmaker: Gantry Secures $20 Million to Recapitalize Beverly Hills Saks Fifth Avenue

Gantry, San Francisco, secured $20 million to recapitalize the signature Beverly Hills location of luxury retailer Saks Fifth Avenue. The loan originated with one of Gantry’s correspondent life company lenders and secured on behalf of the private client property owner.

Stanley Middleman: As We Overcome the Challenges of 2020, Hope Lies Ahead

One third of the way into 2021 we find ourselves immersed in questions and wonderment as to what the future of the residential finance business will look like. Originators join with servicers, investors, and borrowers all wondering what comes next. What does our future hold?

Joe Zeibert of Nomis Solutions on the Upcoming ‘Great Reshuffling’

Joe Zeibert is Managing Director of Global Lending Solutions with Nomis Solutions, Brisbane, Calif. He works closely with clients around the world to identify new mortgage and other consumer lending opportunities.

Seven Takeaways from MBA’s Affordable Rental Housing Summit

Significant affordability challenges exist across the country and the issue is a top priority for the Biden Administration. In April, the Mortgage Bankers Association virtually convened business and policy executives for a series of conversations on the 2021 affordable rental housing landscape. Here are some key takeaways from that event.

Q&A with Gene Ludwig of Promontory MortgagePath

Gene Ludwig is founder of the Promontory family of companies and CEO of Promontory MortgagePath, a technology-based mortgage fulfillment and solutions company. He is also managing partner of Canapi, a venture capital firm focused on investments in early to growth-stage fintech companies. He was Comptroller of the Currency under President Bill Clinton.

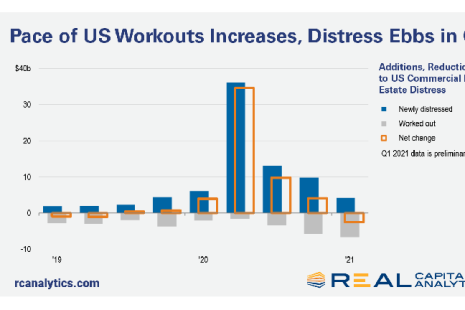

1Q Distressed CRE Debt Drops

More U.S. commercial real estate distress was worked out than arose in the first quarter, reported Real Capital Analytics, New York.

Quote

“The industry is not more difficult to originate in; it is absolutely wide open, which is why we are starting to see competing fintechs enter the home equity lending space. And values continue to rise which increases the potential for equity lending. We are not going to see market values slowdown anytime soon.”

–Omar Jordan, Founder & CEO of LenderClose, West Des Moines, Iowa.