In early May I surveyed 33 senior executives from 33 separate mortgage companies about a myriad of issues and topics both germane and important to the mortgage banking industry. It was the 25th time such a survey was conducted by me since 2008. Until 2020 the surveys were conducted face to face at the MBA National Secondary Market Conference every May and again in October at the MBA’s Annual Convention. However, the pandemic has shifted both sets of contacts to the telephone last year and this.

Category: News and Trends

Omar Jordan of LenderClose on the Evolving Home Equity Loan Market

Omar Jordan is Founder and CEO of LenderClose, West Des Moines, Iowa, a fintech that equips loan originators with the workflows needed to boost efficiencies and shorten the lending cycle through streamlined and meaningful integrations. He founded LenderClose in 2015.

MBA Advocacy Update May 24 2021

Last week, MBA submitted comments supporting the CFPB’s proposed rule to delay the implementation of the Fair Debt Collection Practices Act final rules from November 30, 2021, to January 29, 2022. On Thursday, the Senate Banking Committee held a hearing on housing and infrastructure. And Wednesday, the House Ways and Means Committee held a hearing on tax code options for infrastructure investment.

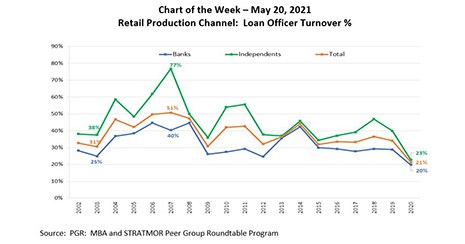

MBA Chart of the Week May 24 2021: Retail Production Channel Loan Officer Turnover

This week’s chart shows the historical retail Loan Officer turnover rates (%) for depository banks and independent mortgage companies, based on data collected through the MBA and STRATMOR Peer Group Roundtable Program, now in its 23rd year of production.

Quote

“The housing supply gap is a national crisis that is chronic and seemingly intractable. It first caught my attention four years ago. I have spent my entire career in housing finance, and I was struck by the amount of attention given to housing finance issues which, albeit important, in my view, pale in comparison to the challenges of scaling the opportunity for affordable homeownership development.”

–Pete Carroll, executive of Public Policy & Industry Relations with CoreLogic, Irvine, Calif., and a member of the CONVERGENCE Memphis Steering Committee.

People in the News May 25, 2021

Notarize, Boston, announced Roger W. Ferguson Jr., joined its board of directors. His career spans more than four decades, including 13 years as CEO of TIAA.

Sponsored Content from ServiceLink: Selecting an AMC Committed to Compliance —Why and How

The largest risk in the real estate lending industry is the collateral securing the loan. Having thorough appraisal and evaluation programs in place is the best insurance to mitigate that risk. ServiceLink’s Laura Raposo explains how lenders can identify and select an AMC with an affirmed commitment to compliance, and the financial strength and stability to adhere to that commitment.

Peter Muoio of SitusAMC Insights: Migration Out of Big Cities Opportunity for Some Who Previously Couldn’t Afford It

Peter Muoio is head of SitusAMC’s Insights division, a provider of technology and services to the real estate finance industry. He has more than 30 years of research and analytics experience in the commercial real estate industry.

MISMO Updates Business Glossary

MISMO®, the real estate finance industry’s standards organization, made significant enhancements to the MISMO Business Glossary, an online resource of mortgage industry business terms and data point descriptions.

Stanley Middleman: As We Overcome the Challenges of 2020, Hope Lies Ahead

One third of the way into 2021 we find ourselves immersed in questions and wonderment as to what the future of the residential finance business will look like. Originators join with servicers, investors, and borrowers all wondering what comes next. What does our future hold?