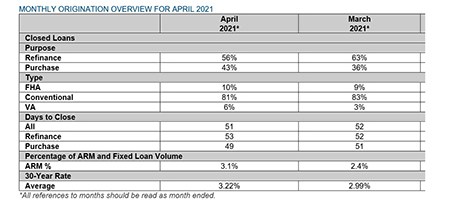

ICE Mortgage Technology, Pleasanton, Calif., issued its Origination Insight Report for April, showing average time to close on all loans fell for the fourth consecutive month to 51 days.

Category: News and Trends

Industry Briefs May 27, 2021

Enact Holdings Inc., Raleigh, N.C., a provider of private mortgage insurance through its insurance subsidiaries, introduced its new brand and visual identity. Formerly known as Genworth Mortgage Holdings Inc., Enact is a wholly owned operating subsidiary of Genworth Financial Inc.

(The New Normal) Larry Silver: The Future of Mortgage Professionals Reimagined for a Hybrid Workplace

Working from home proved liberating for many people, either because they got more work done or they gained a better work-life balance. At this point, we can’t just put the genie back in the bottle. So, how will the mortgage industry manage the shift back to the office, or will they? Now that our face-to-face meeting-driven, paper-intensive industry has been thrust into the future, does it make sense to return to the past?

MBA Weekly Applications Survey May 26, 2021: Purchase Apps Up; Refis Down

Purchase applications rose, but a sharp drop in refinance applications led to an overall drop in mortgage applications last week, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending May 21.

Quote

“Rising prices mean a lot of buyers will need to make compromises to avoid going beyond their financial comfort zone. A buyer who was hoping for a single-family home may need to settle for a condo, and someone who was hoping for a separate home office may have to get creative and carve out part of the living room for a desk.”

–Redfin Chief Economist Daryl Fairweather.

Jim Rosen: Why Now is the Time for eClosings

When it comes to closing, there are lots of moving parts involved that have traditionally been in person or on physical paper. However, things had to change rapidly. Although a challenge in the beginning, it has also presented a large opportunity and given borrowers and lenders more flexibility in how they complete tasks.

MBA CONVERGENCE Partner Profile: Pete Carroll, CoreLogic

Pete Carroll is executive of Public Policy & Industry Relations with CoreLogic, Irvine, Calif., and a member of the CONVERGENCE Memphis Steering Committee.

Tom Lamalfa: May 2021 MBA Spring Conference Survey

In early May I surveyed 33 senior executives from 33 separate mortgage companies about a myriad of issues and topics both germane and important to the mortgage banking industry. It was the 25th time such a survey was conducted by me since 2008. Until 2020 the surveys were conducted face to face at the MBA National Secondary Market Conference every May and again in October at the MBA’s Annual Convention. However, the pandemic has shifted both sets of contacts to the telephone last year and this.

Sponsored Content from ServiceLink: Selecting an AMC Committed to Compliance —Why and How

The largest risk in the real estate lending industry is the collateral securing the loan. Having thorough appraisal and evaluation programs in place is the best insurance to mitigate that risk. ServiceLink’s Laura Raposo explains how lenders can identify and select an AMC with an affirmed commitment to compliance, and the financial strength and stability to adhere to that commitment.

Omar Jordan of LenderClose on the Evolving Home Equity Loan Market

Omar Jordan is Founder and CEO of LenderClose, West Des Moines, Iowa, a fintech that equips loan originators with the workflows needed to boost efficiencies and shorten the lending cycle through streamlined and meaningful integrations. He founded LenderClose in 2015.