When it comes to closing, there are lots of moving parts involved that have traditionally been in person or on physical paper. However, things had to change rapidly. Although a challenge in the beginning, it has also presented a large opportunity and given borrowers and lenders more flexibility in how they complete tasks.

Category: News and Trends

(The New Normal) Larry Silver: The Future of Mortgage Professionals Reimagined for a Hybrid Workplace

Working from home proved liberating for many people, either because they got more work done or they gained a better work-life balance. At this point, we can’t just put the genie back in the bottle. So, how will the mortgage industry manage the shift back to the office, or will they? Now that our face-to-face meeting-driven, paper-intensive industry has been thrust into the future, does it make sense to return to the past?

MBA Advocacy Update June 1, 2021

Washington is anxiously awaiting formal release of President Biden’s full fiscal year 2022 budget proposal, along with the Treasury Department’s “Green Book” itemizing the revenue implications of various tax proposals.

CoreLogic: Home Prices Rise at Fastest Pace Since 2006

CoreLogic, Irvine, Calif., said sparse inventory and high demand placed upward pressure on home prices, leading to a third straight month of double-digit percentage growth.

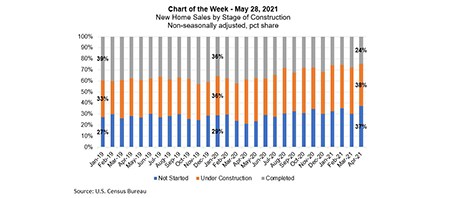

MBA Chart of the Week June 1 2021: New Home Sales By Stage of Construction

This week’s MBA Chart of the Week shows that there is a declining share of completed homes (24 percent) and a growing share of homes sold that were either still under construction (38 percent) or not started (37 percent).

Dealmaker: George Smith Partners Arranges $57M Construction Financing

George Smith Partners, Los Angeles, arranged $56.5 million in construction financing for the development of a mixed-use coastal infill project in Solana Beach, Calif.

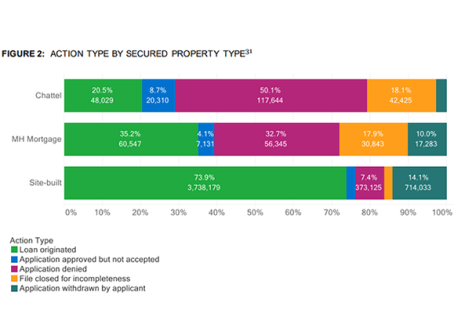

CFPB: Manufactured Housing Loan Borrowers Face Higher Interest Rates, Risks and Barriers to Credit

The Consumer Financial Protection Bureau said manufactured housing can be an affordable but potentially risky avenue for homeownership.

Zaid Shariff of SLK Global Solutions: Avoiding CFPB Regulatory Actions by First Cutting Complaints

Zaid Shariff is vice president – head of solution design and product implementation for SLK Global Solutions, a provider of digital platforms and business process management solutions to the banking, mortgage and financial services industries.

People in the News June 1, 2021

The Mortgage Bankers Association nominated Mark Jones, CEO and Co-Founder of Amerifirst Home Mortgage, Kalamazoo, Mich. to serve as its Vice Chairman for the 2022 membership year.

The Week Ahead—June 1, 2021

Because of yesterday’s holiday, the Mortgage Bankers Association releases its weekly Forbearance & Call Volume Survey today. The survey has shown drops in loans in forbearance for 12 consecutive weeks—will today’s report make it 13? Stay tuned—the report comes out at 4:00 p.m. ET.