Zillow, Seattle, said Asian-headed households in the U.S. grew by 83% in the past two decades, far exceeding Latinx, Black, and white household growth. But that broad success masks major challenges to homeownership in the highly diverse community.

Category: News and Trends

Rick Triola: Proven a 2020 Best-Practice, RON Poised for Standard Operating Procedure in Mortgage Closing

For all intents and purposes, RON has truly been a global solution, and given the renewed effort at the federal level for nationwide RON authorization, the shift may happen sooner rather than later for any remaining nay-sayers.

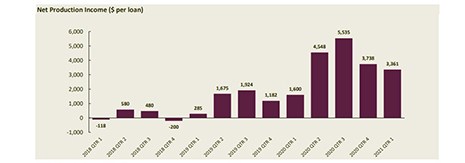

Despite Quarterly Decline, IMB Production Profits Post Record 1st Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $3,361 on each loan they originated in the first quarter, down from $3,738 per loan in the fourth quarter but still the highest first-quarter net gain in the history of the Mortgage Bankers Association’s Quarterly Mortgage Bankers Performance Report.

Mark P. Dangelo: Purging of Underperforming Innovation Firms Is Accelerating

As banking, mortgage and financial services look to remain innovatively different, the quest to “do something” that leverages their people, processes and partners is creating a dystopia during a period of profitability for many leaders unfamiliar with rapid innovations taking place across their markets and offerings.

Zaid Shariff of SLK Global Solutions: Avoiding CFPB Regulatory Actions by First Cutting Complaints

Zaid Shariff is vice president – head of solution design and product implementation for SLK Global Solutions, a provider of digital platforms and business process management solutions to the banking, mortgage and financial services industries.

Quote

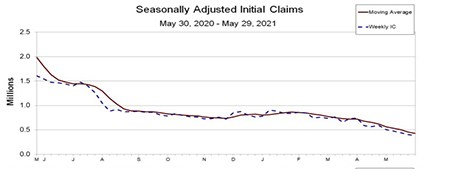

“The decrease in initial claims for unemployment insurance in recent weeks, the continued robust demand for workers as shown by the high level of job openings, and other data showing increasing economic activity, point to more hiring over the summer. MBA is sticking with our forecast of a 4.5% unemployment rate by the end of the year.”

–MBA Chief Economist Mike Fratantoni.

Murali Tirupati: Reducing Loan Defect Risks with Mortgage Document Automation

In this article, we will analyze the bottlenecks due to a manual & paper intensive process that lead to loan defects. Based on this understanding, we will investigate the key business risks from such loan defects and how automation can play a role in mitigating these risks.

FHFA, GSEs Extend COVID-19 Multifamily Forbearance through Sept. 30

The Federal Housing Finance Agency on Thursday said Fannie Mae and Freddie Mac will continue to offer COVID-19 forbearance to qualifying multifamily property owners through September 30.

Initial Claims Down 35% Since April

Initial claims for unemployment insurance fell by another 20,000 last week, the Labor Department reported Thursday, the fifth consecutive weekly drop to the lowest level since March 2020.

Industry Briefs June 4, 2021

Zillow, Seattle, said Asian-headed households in the U.S. grew by 83% in the past two decades, far exceeding Latinx, Black, and white household growth. But that broad success masks major challenges to homeownership in the highly diverse community.