Lisa Springer is a senior partner and CEO of STRATMOR Group, Greenwood Village, Colo., a data-driven mortgage advisory firm. She provides direction and leadership to achieve the firm’s strategic goals.

Category: News and Trends

Nadim Homsany: How IMBs Can Digitize Mortgage Coupons to Lower Costs and Risks

Digitizing traditional paper coupons are one easy way for IMBs to increase efficiency, boost customer satisfaction and decrease the risk of payment delinquency, all while jumpstarting the move to low-risk, low-cost digitally automated processes.

MBA DEI Leadership Awards: Nomination Deadline Aug. 13

The Mortgage Bankers Association recognizes residential and commercial/multifamily members who show leadership in the areas of Diversity, Equity and Inclusion (DEI) internally through market outreach efforts with its annual DEI Leadership Awards. Nomination deadline for this year’s awards is Aug. 13.

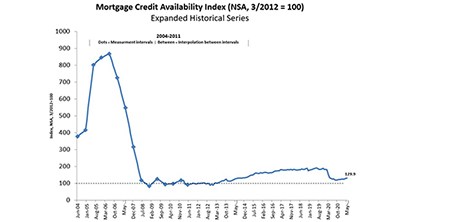

May Mortgage Credit Availability Increases by 1.4%

Mortgage credit availability increased in May to its highest level since the onset of the coronavirus pandemic, but remained well below its 2019 peak levels, the Mortgage Bankers Association reported Thursday.

Dealmaker: Dwight Capital Finances $126M

Dwight Capital, New York, closed $126.2 million in financings for multifamily properties in three states.

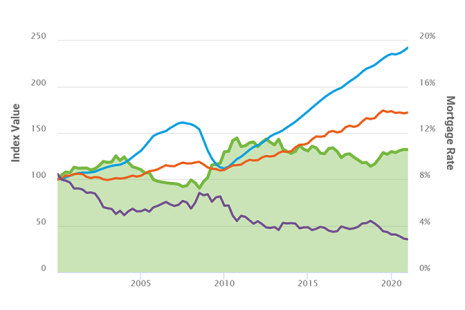

Apartment Investment Environment Stays Steady

Freddie Mac, McLean, Va., said its Apartment Investment Market Index held steady in the first quarter as continuing low interest rates support the sector.

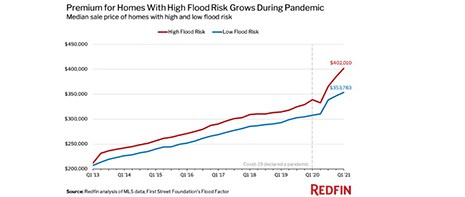

Despite Risk, Homes in High-Flood Areas Flying Off the (Continental) Shelves

Hurricane seasons and climate change are threatening to redraw coastal U.S. maps. But it’s not stopping homebuyers from chasing down waterfront properties.

Tom Millon, CMB, of Computershare Loan Services on Default Loan Servicing

Tom Millon, CMB, is CEO of Computershare Loan Services US, Ponte Vedra Beach, Fla.

Call for Speakers: MBA Risk Management, QA & Fraud Prevention Forum–Deadline June 29

Full session and individual speaker proposals are now being accepted for the Mortgage Bankers Association’s Risk Management, QA and Fraud Prevention Forum 2021, taking place Sept. 28–29 via MBA LIVE.

MBA CONVERGENCE Partner Profile: Cheryl Muhammad, Assured Real Estate Services

Cheryl Muhammad is owner and CEO of Assured Real Estate Services, Memphis, Tenn., which she founded in 2005. She is responsible for the company’s day-to-day operations. She has been an award-winning full-time real estate agent since 1999. She serves as Co-Chair of the CONVERGENCE Memphis Information and Trust Gap Workstream.