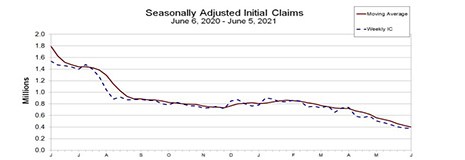

Initial claims for unemployment insurance fell for the sixth straight week, reaching the lowest level since before the coronavirus pandemic’s economic impact, the Labor Department reported Thursday.

Category: News and Trends

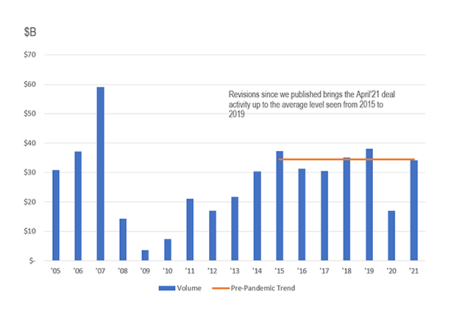

Commercial Real Estate Not Yet Out of the Woods

U.S. commercial real estate investment increased in April, but not all pandemic-related problems are in the rearview mirror, reported Real Capital Analytics, New York.

People in the News June 11, 2021

Maxwell, Denver, hired Sadie Gurley as Vice President, responsible for helping the company find new opportunities and expand its impact on community lenders across the country.

Single-Family Rentals Rising: A Conversation With Berkadia

One result of a strong housing market driven by low rates, high demand and supply constraints is a substantial increase in investor interest in single-family rental housing. MBA NewsLink interviewed Berkadia executives Hilary Provinse and Dori Nolan about the SFR landscape and the outlook for this burgeoning sector.

Dealmaker: Sonnenblick-Eichner Arranges $30M to Refi California Office

Sonnenblick-Eichner Co., Beverly Hills, Calif., arranged $30 million of first mortgage debt for Continental Development Corp. to refinance 1888 Rosecrans Avenue in Manhattan Beach, Calif.

Quote

“Homeowner equity has more than doubled over the past decade and become a crucial buffer for many weathering the challenges of the pandemic. These gains have become an important financial tool and boosted consumer confidence in the U.S. housing market, especially for older homeowners and baby boomers who’ve experienced years of price appreciation.”

–Frank Martell, president and CEO of CoreLogic, Irvine, Calif.

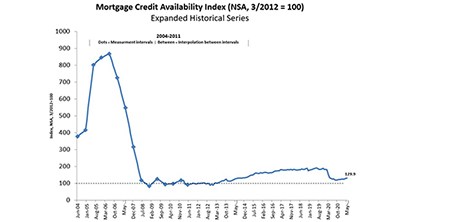

May Mortgage Credit Availability Increases by 1.4%

Mortgage credit availability increased in May to its highest level since the onset of the coronavirus pandemic, but remained well below its 2019 peak levels, the Mortgage Bankers Association reported Thursday.

MBA CONVERGENCE Partner Profile: Cheryl Muhammad, Assured Real Estate Services

Cheryl Muhammad is owner and CEO of Assured Real Estate Services, Memphis, Tenn., which she founded in 2005. She is responsible for the company’s day-to-day operations. She has been an award-winning full-time real estate agent since 1999. She serves as Co-Chair of the CONVERGENCE Memphis Information and Trust Gap Workstream.

Tom Millon, CMB, of Computershare Loan Services on Default Loan Servicing

Tom Millon, CMB, is CEO of Computershare Loan Services US, Ponte Vedra Beach, Fla.

Call for Speakers: MBA Risk Management, QA & Fraud Prevention Forum–Deadline June 29

Full session and individual speaker proposals are now being accepted for the Mortgage Bankers Association’s Risk Management, QA and Fraud Prevention Forum 2021, taking place Sept. 28–29 via MBA LIVE.