Discover five common scenarios in mortgage lending to help your enterprise get started with machine learning.

Category: News and Trends

People in the News June 14, 2021

Maxwell, Denver, hired Sadie Gurley as Vice President, responsible for helping the company find new opportunities and expand its impact on community lenders across the country.

Quote

“As the Administration continues its support for housing, we urge you to sunset the nationwide federal moratorium on evictions on June 30th and focus on targeted housing support for those renters who continue to recover from the pandemic.”

–from a June 11 letter signed by MBA and a dozen industry trade groups to the Biden Administration.

Single-Family Rentals Rising: A Conversation With Berkadia

One result of a strong housing market driven by low rates, high demand and supply constraints is a substantial increase in investor interest in single-family rental housing. MBA NewsLink interviewed Berkadia executives Hilary Provinse and Dori Nolan about the SFR landscape and the outlook for this burgeoning sector.

Tom Millon, CMB, of Computershare Loan Services on Default Loan Servicing

Tom Millon, CMB, is CEO of Computershare Loan Services US, Ponte Vedra Beach, Fla.

Lisa Springer of STRATMOR Group: Relieving Workforce Burnout Through Technology

Lisa Springer is a senior partner and CEO of STRATMOR Group, Greenwood Village, Colo., a data-driven mortgage advisory firm. She provides direction and leadership to achieve the firm’s strategic goals.

MBA CONVERGENCE Partner Profile: Cheryl Muhammad, Assured Real Estate Services

Cheryl Muhammad is owner and CEO of Assured Real Estate Services, Memphis, Tenn., which she founded in 2005. She is responsible for the company’s day-to-day operations. She has been an award-winning full-time real estate agent since 1999. She serves as Co-Chair of the CONVERGENCE Memphis Information and Trust Gap Workstream.

Nadim Homsany: How IMBs Can Digitize Mortgage Coupons to Lower Costs and Risks

Digitizing traditional paper coupons are one easy way for IMBs to increase efficiency, boost customer satisfaction and decrease the risk of payment delinquency, all while jumpstarting the move to low-risk, low-cost digitally automated processes.

HUD Restores Affirmatively Furthering Fair Housing Requirement

HUD published an interim final rule on Thursday to restore implementation of the Fair Housing Act’s Affirmatively Furthering Fair Housing requirement, which was discontinued during the Trump Administration.

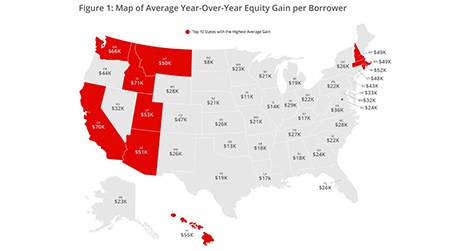

1Q Homeowner Equity Gains $1.9 Trillion

Corelogic, Irvine, Calif., said “underwater” (negative equity) homes decreased by 24% year over year in the first quarter, while the average homeowner gained $33,400 in equity year over year.