One result of a strong housing market driven by low rates, high demand and supply constraints is a substantial increase in investor interest in single-family rental housing. MBA NewsLink interviewed Berkadia executives Hilary Provinse and Dori Nolan about the SFR landscape and the outlook for this burgeoning sector.

Category: News and Trends

Tom Millon, CMB, of Computershare Loan Services on Default Loan Servicing

Tom Millon, CMB, is CEO of Computershare Loan Services US, Ponte Vedra Beach, Fla.

MBA CONVERGENCE Partner Profile: Cheryl Muhammad, Assured Real Estate Services

Cheryl Muhammad is owner and CEO of Assured Real Estate Services, Memphis, Tenn., which she founded in 2005. She is responsible for the company’s day-to-day operations. She has been an award-winning full-time real estate agent since 1999. She serves as Co-Chair of the CONVERGENCE Memphis Information and Trust Gap Workstream.

MBA Advocacy Update June 14, 2021

Last week on Capitol Hill, the House Transportation & Infrastructure Committee held a markup on the INVEST in America Act, and HUD Secretary Marcia Fudge appeared before the Senate T-HUD Appropriations subcommittee to discuss the FY 2022 budget. On Monday, Freddie Mac issued a bulletin providing further details regarding its implementation of recently-adopted limits on deliveries of loans secured by second homes and investor properties.

Dealmaker: JLL Secures $36M For Industrial, Retail

JLL Capital Markets, Chicago, arranged $36.2 million in acquisition and refinancing for industrial and retail assets in Pennsylvania, New Jersey and Florida.

Fewer Firms Plan to Shrink Office Portfolios

U.S. companies have scaled back their plans to make big cuts to their office portfolios and many now expect their offices to support “collaborative” work in person rather than remotely, said CBRE, Dallas.

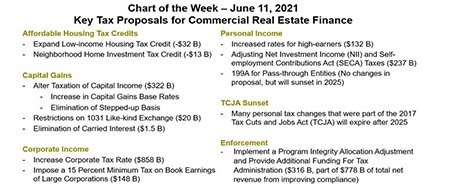

MBA Chart of the Week June 14, 2021: Key Tax Proposals for Commercial Real Estate Finance

The Biden Administration’s proposed Fiscal Year 2022 Budget put down in black and white – and dollars and cents – many suggestions that have been made in more general terms in the Administration’s American Jobs and Family Plan, during the most recent presidential campaigns and in some cases going back decades.

MBA, Real Estate Industry Commend Administration for Recovery Efforts; Call for End to Nationwide Eviction Moratorium

The Mortgage Bankers Association and a broad real estate coalition on Friday commended measures President Biden has taken to stabilize the housing sector and urged the administration to sunset the federal moratorium on evictions on June 30.

Shawn Ansley of VICE Capital Markets: The Need for Strong Data/System Integrations in Hedging

While “The Law of Averages” may apply to a wide variety of activities, hedging isn’t one of them. For a mortgage lender to extract the most value out of their hedging strategy, that strategy must be specific to their organization and its unique make-up.

The Week Ahead—June 15, 2021

Good morning! While Congress continues to work out a compromise on infrastructure legislation, eyes shift to Foggy Bottom, where the Federal Open Market Committee meets this week to figure out if inflation has become a problem.