NorthMarq, Minneapolis, arranged $35M to refinance mixed-use and multifamily properties in Texas and Arizona.

Category: News and Trends

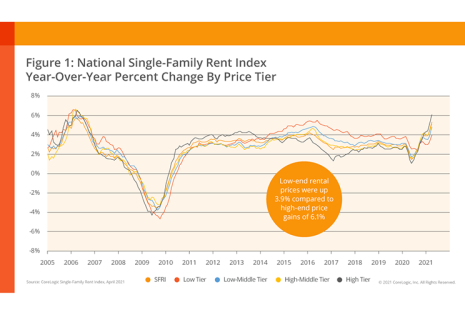

Single-Family Rent Growth Exceeds Pre-Pandemic Rates

Rent growth in single-family rental properties now exceeds pre-pandemic rates across all price tiers, including low-end rentals for the first time, reported CoreLogic, Irvine, Calif.

Material Challenges Dampen Home Builder Sentiment

In the first of three reports this week on new home building, the National Association of Home Builders said rising material prices and supply chain shortages resulted in builder confidence dipping to its lowest level since August 2020.

ATTOM: May Foreclosure Starts Up 36% YOY

ATTOM, Irvine, Calif., reported 10,821 U.S. properties with foreclosure filings in May, down 8 percent from a month ago but up 23 percent from a year ago. Foreclosure starts, which represent the initial notice of default, grew by 36 percent year-over-year.

Jim Paolino of Mortgage Sentinel: It’s Time for Lenders to Start Planning for a Changing Market

Demographic and other changes indicate mortgage industry is at a crossroads with the way we’ve done business for years.

Former MBA Chairman Michael Young Passes Away

The Mortgage Bankers Association learned of the recent death of Michael W. Young, who founded Cenlar Federal Savings Bank, Ewing, N.J., and served as MBA Chairman in 2011-2012.

Dealmaker: NorthMarq Secures $35M to Refinance Mixed-Use, Multifamily

NorthMarq, Minneapolis, arranged $35M to refinance mixed-use and multifamily properties in Texas and Arizona.

Tom Millon, CMB, of Computershare Loan Services on Default Loan Servicing

Tom Millon, CMB, is CEO of Computershare Loan Services US, Ponte Vedra Beach, Fla.

Shawn Ansley of VICE Capital Markets: The Need for Strong Data/System Integrations in Hedging

While “The Law of Averages” may apply to a wide variety of activities, hedging isn’t one of them. For a mortgage lender to extract the most value out of their hedging strategy, that strategy must be specific to their organization and its unique make-up.

Sponsored Content from InRule: Transform Mortgage Lending and Real Estate with Machine Learning

Discover five common scenarios in mortgage lending to help your enterprise get started with machine learning.