While “The Law of Averages” may apply to a wide variety of activities, hedging isn’t one of them. For a mortgage lender to extract the most value out of their hedging strategy, that strategy must be specific to their organization and its unique make-up.

Category: News and Trends

Sponsored Content from InRule: Transform Mortgage Lending and Real Estate with Machine Learning

Discover five common scenarios in mortgage lending to help your enterprise get started with machine learning.

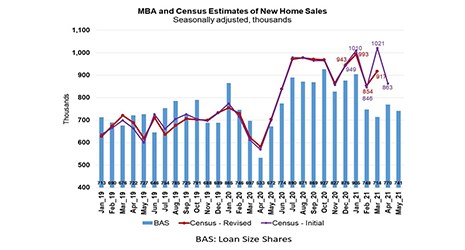

May New Home Purchase Mortgage Applications Decline

Mortgage applications for new home purchases fell for the second straight month amid tight inventories and sharply rising prices, the Mortgage Bankers Association reported Thursday.

Zillow: Inventory Rebounds Amid Record Home Value, Rent Growth

Zillow, Seattle, said continued torrid growth in the housing market paired with a long-awaited bump in inventory in May,

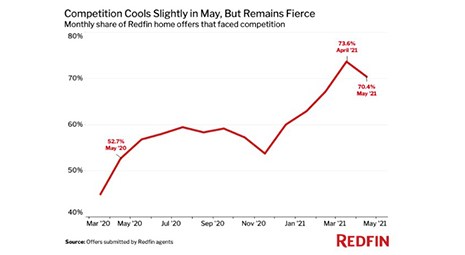

Redfin: 7 in 10 Buyers Still Face Bidding Wars

Redfin, Seattle, said 70.4% of home offers written by Redfin agents faced competition in May, down from 73.6% in April, but still up significantly from 52.7% a year ago.

1st Quarter Home Flipping Rate at 21-Year Low; Profits Decline

ATTOM, Irvine, Calif., said home flipping activity fell in the first quarter to the lowest level since 2000.

Fed Sees Rising Economic Growth—and Inflation; Moves Up Rate Hike Timetable

The Federal Reserve isn’t raising interest rates anytime soon, but it did suggest Wednesday that the timetable for increases could begin sooner in 2023 if economic growth and inflation continue to rise faster than expected.

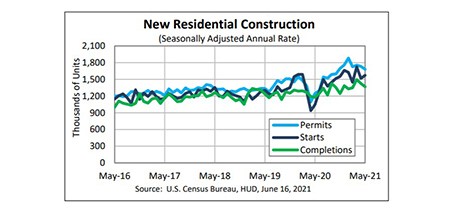

May Housing Starts Seesaw Back on Track

One step back; one step forward. Housing starts have alternated between up and down during 2021, and in keeping with the pattern, improved in May after declining in April, HUD and the Census Bureau reported Wednesday.

Dealmaker: Keystone Mortgage Corp. Arranges $26M for Mixed-Use, Office Assets

Keystone Mortgage Corp., Manhattan Beach, Calif., arranged a $21.3 million refinancing for SALT Oceanside, a mixed-use apartment/retail property in Oceanside, Calif.

The State of the Nation’s Housing: Millions Face Risk of Eviction or Foreclosure

Households that weathered the pandemic without financial distress are “snapping up” the limited supply of homes for sale, pushing up prices and excluding less-affluent buyers from homeownership, the Joint Center for Housing Studies at Harvard University reported Wednesday.