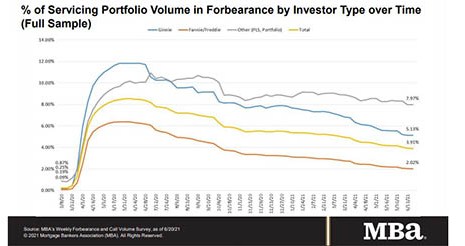

Loans in forbearance fell for the 17th straight week–and for the second straight week, remained below 4 percent–the Mortgage Bankers Association reported Monday.

Category: News and Trends

Sherri Carr: A New Solution for Variable-Rate Loan Products

As competition heats up in the face of the anticipated slowdown in mortgage demand, adjustable-rate loans will become an important competitive tool for many loan originators.

Quote

“Well-intentioned but misguided legislation like the Carried Interest Fairness Act and the President’s budget proposal to tax carried interests as ordinary income, would result in an enormous tax increase on countless Americans who use partnerships to develop, own and operate real estate. These sweeping changes, if enacted, would discourage individuals from pursuing their entrepreneurial vision, tax the sweat equity that makes real estate more productive and useful and slow economic growth. The results would be particularly harmful to industries that seek to build a business or asset with lasting value over an extended time horizon.”

–From an MBA/trade group letter to Capitol Hill opposing legislation and an Administration budget proposal that would broadly change tax laws on “carried interest.”

MBA RIHA Study: Older Homeowners, College-Educated Individuals More Likely to Leave Workforce After Job Loss

Older college-educated homeowners are two times more likely to leave the workforce after a job loss than renters, according to a new research report released Tuesday by the Mortgage Bankers Association’s Research Institute for Housing America.

Mark P. Dangelo: aaS, the Building Blocks for an Uncertain Future, Part 3

Future market offerings and IT system delivery are being altered by the exponential expansion of granular, stackable aaS solutions. For industry leaders unaccustomed to using cross-industry building blocks and iterations of offerings, they will find declining profitability against rising industry disintermediation against their core products and services.

Matt Hansen: Get Your Back Up Off the Wall: Support MBA RON Advocacy Efforts

To extend Remote Online Notarization legislation nationwide, lenders are going to have to get their “back up off the wall” and join MBA efforts to press rulemakers for laws that enable homebuyers and the real estate finance industry to benefit from modern business practices that so many other industries already enjoy.

Call for Speakers: MBA Regulatory Compliance Conference, Deadline July 2

The Mortgage Bankers Association issued a Call for Speakers for its Regulatory Compliance Conference, taking place Sept. 12-14 at the Grand Hyatt in Washington, D.C. Speaker proposals are due Friday, July 1.

People in the News June 30, 2021

The White House appointed Sandra L. Thompson as Acting Director of the Federal Housing Finance Agency effective immediately.

Sherri Carr: A New Solution for Variable-Rate Loan Products

As competition heats up in the face of the anticipated slowdown in mortgage demand, adjustable-rate loans will become an important competitive tool for many loan originators.

MBA: Share of Mortgage Loans in Forbearance Falls 17th Straight Week

Loans in forbearance fell for the 17th straight week–and for the second straight week, remained below 4 percent–the Mortgage Bankers Association reported Monday.