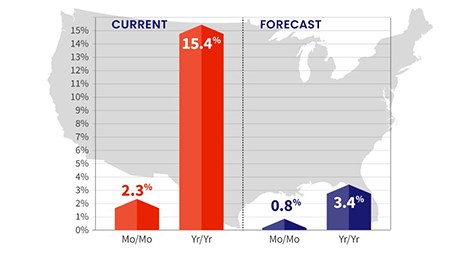

Our story so far: high demand for housing, coupled with near record-low inventories, results in double-digit annual home price growth. CoreLogic, Irvine, Calif., is the latest to confirm the trend.

Category: News and Trends

MBA Advocacy Update July 6 2021

The CFPB released its final rule amending select requirements of Regulation X to assist borrowers impacted by COVID-19. Also last week, MBA President and CEO Bob Broeksmit, CMB, sent a letter to the leaders of the National Governors Association and CSBS to ask for their assistance in addressing the challenges MBA member companies face as they attempt to reopen their offices.

Quote

“For the first time since last March, the share of Fannie Mae and Freddie Mac loans in forbearance dropped below 2 percent. The share in every investor type and almost every loan category dropped as well, bringing the number of homeowners in forbearance below 2 million. The rate of forbearance exits and new forbearance requests remained at low levels, but we expect the pace of exits to increase with reporting next week for the beginning of July.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

MBA CONVERGENCE Partner Profile: Laird Nossuli, iEmergent

Laird Nossuli is CEO of iEmergent, Urbandale, Iowa, an analytics and advisory firm that helps lenders leverage data and diversity to develop sustainable lending strategies. Her educational background in community development and her passion for housing equity fuel her participation as a Steering Committee member in CONVERGENCE Columbus and led to iEmergent’s role as a national partner.

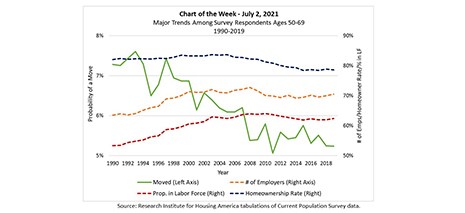

MBA Chart of the Week July 6 2021: Older Workers’ Labor Force Participation

The Research Institute for Housing America, MBA’s think tank, released a special report that examines why, since the 1990s, older workers’ labor force participation has increased while their migration has decreased, counter to conventional economic wisdom.

Industry Briefs July 7, 2021

The Federal Housing Finance Agency issued a Policy Statement on Fair Lending. The Policy Statement communicates FHFA’s commitment to comprehensive fair lending oversight of Fannie Mae, Freddie Mac and the Federal Home Loan Banks and provides a foundation for building out FHFA’s fair lending program.

People in the News July 6, 2021

The Mortgage Bankers Association announced Teressa Lurk, Vice President of Marketing and Design, was recognized by HousingWire as a recipient of the publication’s inaugural 2021 Marketing Leader award, which recognizes creative and influential marketing minds in the housing industry.

Clint Salisbury: The RON Revelation–Why a Return to Normal Shouldn’t Mean a Return to the Status Quo

With recent events leading to a massive increase in the use of RON, borrowers have seen they can close on their mortgage from the convenience of their kitchen table, and they’re wondering why that can’t always be the case.

Grant Carlson: The Supreme Court Ruling on CDC Residential Eviction Moratorium

On Tuesday the U.S. Supreme Court in, a 5-4 ruling, declined to lift the national Center for Disease Control and Prevention’s residential eviction moratorium. The ruling responds to a request to lift the D.C. Federal District Court’s stay, which has effectively paused its order invalidating the CDC moratorium. Presumably, the CDC eviction moratorium will expire on July 31.

MBA DEI Leadership Awards: Nomination Deadline Aug. 13

Inspire change; share success. The Mortgage Bankers Association recognizes residential and commercial/multifamily members who show leadership in the areas of Diversity, Equity and Inclusion (DEI) internally through market outreach efforts with its annual DEI Leadership Awards.