In this article, we’ll discuss how EDI and RPA technologies help lenders streamline insurance tracking and verification and reduce direct member contact.

Category: News and Trends

Quote

“Remote work has allowed many homebuyers to leave cities for far-flung suburbs. Those suburbs often lack public transit, so new residents drive more often. Hopefully, a less frequent commute will mean fewer hours behind the wheel. But as offices reopen, we may see commuters who used to live in the city and use public transit spending more time driving and emitting more carbon. Governments need to plan for this new reality and start providing more green transit to areas outside of major cities.”

–Daryl Fairweather, Chief Economist with Redfin, Seattle.

People in the News July 12, 2021

Wipro Opus Risk Solutions LLC, tapped Greer Allgood as managing director of mortgage operations. She is responsible for overall management of specific client and deal transactions.

Jennifer Henry: The Role Third-Party Data Plays for Mortgage Originators and Servicers

Lenders and servicers alike must focus on streamlining processes through automated technology and data-enabled solutions to sustain a more profitable business model and manage the shifts and demands of the marketplace.

Call for Speakers: MBA Annual Convention & Expo; Deadline July 16

Speaking proposals for breakout sessions are now being accepted for the Mortgage Bankers Association’s Annual Convention & Expo 2021, taking place October 17-20 at the San Diego Convention Center.

Paradatec’s Neil Fraser: For Servicers, Pandemic-Related Challenges Are Just Beginning

Neil Fraser is Director of U.S. Operations for Paradatec, Cincinnati, Ohio, a provider of AI-based document classification and data extraction technology for mortgage loan processing. He manages all of Paradatec’s operations and has grown the company every year since its incorporation in 2002.

MBA CONVERGENCE Partner Profile: Laird Nossuli, iEmergent

Laird Nossuli is CEO of iEmergent, Urbandale, Iowa, an analytics and advisory firm that helps lenders leverage data and diversity to develop sustainable lending strategies. Her educational background in community development and her passion for housing equity fuel her participation as a Steering Committee member in CONVERGENCE Columbus and led to iEmergent’s role as a national partner.

MBA Letter Urges Support of HUD Priorities in Fiscal 2022 Appropriations Bill

Ahead of a scheduled vote next week, the Mortgage Bankers Association asked the House Appropriations Committee to support key fiscal year 2022 appropriations proposed to HUD, FHA and Ginnie Mae.

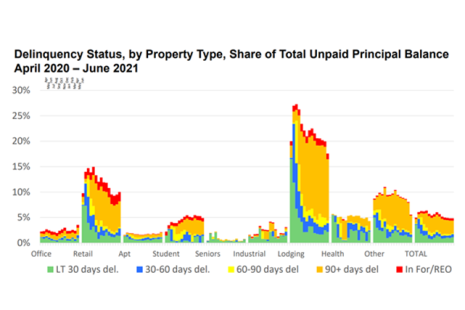

June Commercial, Multifamily Mortgage Delinquencies Hold Steady

Delinquency rates for mortgages backed by commercial and multifamily properties held steady in June, the Mortgage Bankers Association’s latest monthly CREF Loan Performance Survey said.

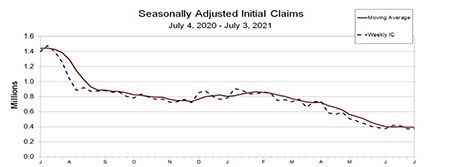

Initial Claims Rise Unexpectedly

Initial claims for unemployment insurance rose unexpectedly last week, signaling a potentially volatile period ahead as more than half of U.S. states end government-funded unemployment programs.