Inspire change; share success. The Mortgage Bankers Association recognizes residential and commercial/multifamily members who show leadership in the areas of Diversity, Equity and Inclusion (DEI) internally through market outreach efforts with its annual DEI Leadership Awards.

Category: News and Trends

Fannie Mae: Homebuyer Satisfaction with Mortgage Process Remains High

Homebuyer satisfaction with the mortgage process remained high during the pandemic year, said Fannie Mae, despite most lenders facing the challenges of remote working and increased volume.

Share of Homes Bought with All Cash Hits 30% for First Time Since 2014

Redfin, Seattle, said nearly one-third (30%) of U.S. home purchases this year were paid for with all cash, up from 25.3% during all of 2020 to the largest share since 2014 (30.6%).

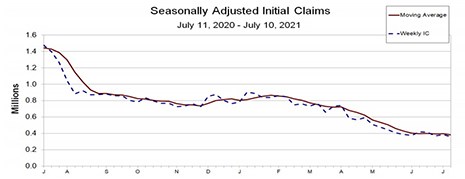

Unemployment Claims Push Closer to Pre-Pandemic Levels

Initial claims for unemployment insurance fell by another 26,000 last week, edging closer to “normal” by pre-pandemic measures.

Industrial Sector Demand, Deliveries Reach New Records

The industrial sector saw record-setting demand and deliveries in first-half 2021, reported Cushman & Wakefield, Chicago.

Dealmaker: Mesa West Capital Provides $188M to Finance Three Multifamily Transactions

Mesa West Capital, Los Angeles, funded $187.5 million in first mortgage debt secured by apartment communities in Chicago, Phoenix and Portland, Ore.

Murali Tirupati: How Mortgage Servicers Can Improve Operations with an ‘Automation-First’ Strategy

Mortgage servicers are under tremendous pressure to not just onboard loan files faster but do so in compliance with regulatory requirements of CFPB.

MBA Condo Lending Workshop: Focus on the Government Market July 22

A half-day online event taking place Thursday, July 22 from 1:00-5:00 p.m. ET, the Condominium Lending Workshop: Focus on the Government Market features experts from FHA, VA and other lenders as they discuss latest trends and guidelines in government condo lending.

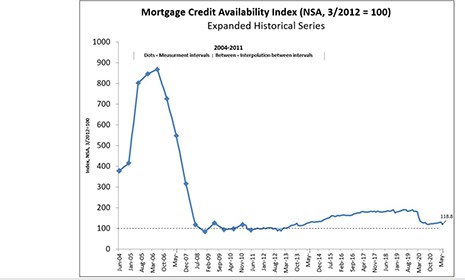

June Mortgage Credit Availability Down 8.5%

Mortgage credit availability decreased in June to its lowest level since September, the Mortgage Bankers Association reported Thursday.

MBA CONVERGENCE Takes Big Next Step in Columbus

MBA CONVERGENCE, the Mortgage Bankers Association’s initiative to promote minority homeownership opportunities, launches its second major pilot program July 21 in Columbus, Ohio.