Strong buyer demand partially offset building material supply-side challenges, regulation and labor as builder confidence in the market for newly built single-family homes inched down one point to 80 in July, the National Association of Home Builders/Wells Fargo Housing Market Index reported.

Category: News and Trends

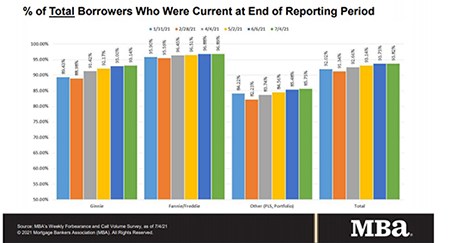

Share of Mortgage Loans in Forbearance Decreases

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased

Maintenance on Nationwide Multistate Licensing System, NMLS Consumer Access Scheduled for July 21-26

The Nationwide Multistate Licensing System (NMLS) and NMLS Consumer Access will be unavailable due to planned system maintenance Wednesday, July 21 at 8:00 PM ET through Monday, July 26 at 7:00 AM ET.

Share of Homes Bought with All Cash Hits 30% for First Time Since 2014

Redfin, Seattle, said nearly one-third (30%) of U.S. home purchases this year were paid for with all cash, up from 25.3% during all of 2020 to the largest share since 2014 (30.6%).

Quote

“Forbearance exits edged up again last week and new forbearance requests dropped to their lowest

level since last March, leading to the largest weekly drop in the forbearance share since last October and

the 20th consecutive week of declines.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

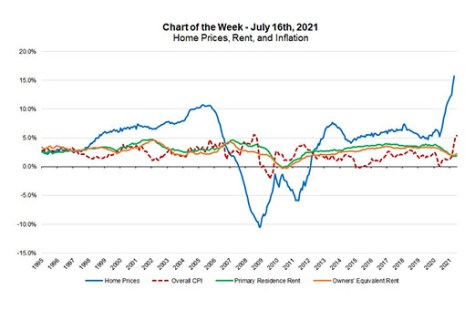

MBA Chart of the Week, July 19, 2021: Home Prices, Rent and Inflation

Federal Reserve Chair Jay Powell testified before Congress last week and received several questions regarding recent inflation trends, with overall CPI inflation increasing 5.4 percent in June 2021 compared to a year ago. This followed readings of 4.2 percent in April and 5.0 percent in May. The headline inflation number was the highest in 13 years, while the recent monthly pace of core inflation is the highest since the early 1980s.

FHFA Eliminates 50 Basis Point ‘Adverse Market Refinance Fee’

The Federal Housing Finance Agency announced that Fannie Mae and Freddie Mac will eliminate the 50 basis point “Adverse Market Refinance Fee” for loan deliveries effective August 1.

Authors Malcolm Gladwell, Brad Meltzer Keynote MBA Annual Convention & Expo

Registration for the Mortgage Bankers Association’s Annual Convention & Expo, taking place Oct. 17-20 at the San Diego Convention Center, is officially open. Join MBA in San Diego as New York Times best-selling authors Malcolm Gladwell and Brad Meltzer keynote General Sessions on Tuesday, Oct. 19.

Murali Tirupati: How Mortgage Servicers Can Improve Operations with an ‘Automation-First’ Strategy

Mortgage servicers are under tremendous pressure to not just onboard loan files faster but do so in compliance with regulatory requirements of CFPB.

MBA CONVERGENCE Takes Big Next Step in Columbus

MBA CONVERGENCE, the Mortgage Bankers Association’s initiative to promote minority homeownership opportunities, launches its second major pilot program July 21 in Columbus, Ohio.