Mortgage servicers are under tremendous pressure to not just onboard loan files faster but do so in compliance with regulatory requirements of CFPB.

Category: News and Trends

Today: MBA CONVERGENCE Takes Big Next Step in Columbus

MBA CONVERGENCE, the Mortgage Bankers Association’s initiative to promote minority homeownership opportunities, launches its second major pilot program today, July 21 in Columbus, Ohio.

MBA DEI Leadership Awards: Nomination Deadline Aug. 13

Inspire change; share success. The Mortgage Bankers Association recognizes residential and commercial/multifamily members who show leadership in the areas of Diversity, Equity and Inclusion (DEI) internally through market outreach efforts with its annual DEI Leadership Awards.

mPowering You: MBA’s Summit for Women in Real Estate Finance Oct. 16

mPowering You, MBA’s Summit for Women in Real Estate Finance, takes place Saturday, Oct. 16 at the San Diego Convention Center just ahead of the MBA Annual Convention & Expo …

Maintenance on Nationwide Multistate Licensing System, NMLS Consumer Access Scheduled for July 21-26

The Nationwide Multistate Licensing System (NMLS) and NMLS Consumer Access will be unavailable due to planned system maintenance Wednesday, July 21 at 8:00 PM ET through Monday, July 26 at 7:00 AM ET.

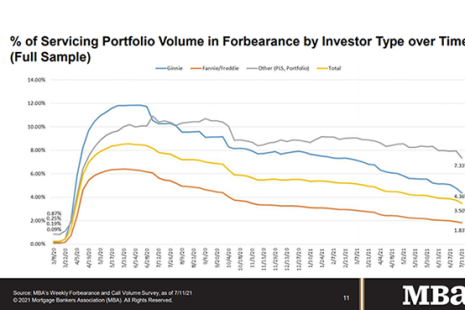

Share of Mortgage Loans in Forbearance Decreases to 3.50%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 26 basis points to 3.50% of servicers’ portfolio volume as of July 11–the twentieth consecutive weekly decline.

MBA Advocacy Update July 19, 2021

Last Friday, FHFA announced the removal of the GSEs’ 50-basis-point adverse market fee in response to both industry advocacy and improved market conditions.

Dealmaker: Dockerty Romer Arranges $63M for Florida Multifamily

Dockerty Romer & Co., Delray Beach, Fla., arranged $63 million in permanent mortgage financing for a West Palm Beach, Fla., multifamily community.

Commercial, Multifamily Briefs from CBRE, Enterprise Community Partners

CBRE Group, Dallas, acquired Union Gaming, an investment bank and advisory firm focused on the global gaming sector.

Housing Market Expected to Remain Strong Despite Supply, Price Concerns

The low mortgage rates that have supported the housing market throughout the pandemic will likely increase later this year, but just gradually, said Freddie Mac, McLean, Va.