The Mortgage Bankers Association’s grassroots advocacy arm, the Mortgage Action Alliance, issued a ‘Call to Action’ on Monday to its 70,000-plus members urging them to tell their elected officials to not use government-sponsored enterprise guaranty fees (g-fees) as a source of funding offsets.

Category: News and Trends

Quote

“A month ago, I described April’s [housing price growth] performance as ‘truly extraordinary,’ and this month I find myself running out of superlatives.”

–Craig Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P DJI.

Key Takeaways from MBA Webinar: It’s a Wonderful Life Insurance Company Market

The Mortgage Bankers Association co-hosted a virtual panel with the California Mortgage Bankers Association and the American Council of Life Insurers on July 14. Five panelists represented firms with a variety of commercial real estate debt and equity strategies and buckets of capital including substantial life insurance company capital.

MBA DEI Leadership Awards: Nomination Deadline Aug. 13

Inspire change; share success. The Mortgage Bankers Association recognizes residential and commercial/multifamily members who show leadership in the areas of Diversity, Equity and Inclusion (DEI) internally through market outreach efforts …

Industry Briefs July 28, 2021

NotaryCam, Newport Beach, Calif., partnered with RUTH RUHL P.C., a Texas-based law firm, to add security and automation to the firm’s loss mitigation services through remote online notarization.

MBA Seeks Participants in New Diversity, Equity and Inclusion Study

The Mortgage Bankers Association introduces a new offering to its members — the Diversity, Equity and Inclusion (DEI) Study — separately designed and compiled for both the residential and commercial/multifamily sides of the real estate finance industry

Mark P. Dangelo: The Dark Matter Transforming M&A Post-Deal Landscapes, Part 1

Industry 4.0 for banking and financial services is changing the landscape of the who, what, where, why, and how of M&A targets and post-deal actions. Prescriptions are out—a new framework is in due to non-stop deals, vast data, and layers upon layers of new innovations. M&A actions moving forward are all about “Are we asking the right questions?”

Call for Speakers: MBA Independent Mortgage Bankers Conference 2022: Deadline Aug. 20

The Mortgage Bankers Association is now accepting speaker proposals for its Independent Mortgage Bankers Conference 2022, taking place January 24-27 in Nashville, Tenn. This annual event is the largest gathering of non-bank mortgage lenders and is purpose-built for the IMB.

Rita Moreno Keynotes mPower Luncheon at MBA Annual Convention & Expo

Registration for the Mortgage Bankers Association’s Annual Convention & Expo, taking place Oct. 17-20 at the San Diego Convention Center, is officially open. Join MBA in San Diego as Academy Award- and Presidential Medal of Freedom Award-winning actress Rita Moreno keynotes the mPower Luncheon on Tuesday, Oct. 19.

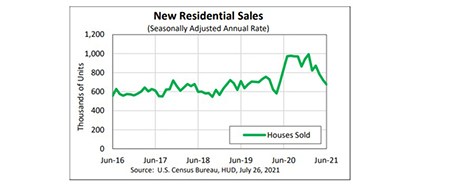

June New Home Sales Down 6.6%

June new home sales fell well below consensus expectations, HUD and the Census Bureau reported Monday, though analysts did not appear to be too worried by the results.