On Tuesday the Conference of State Bank Supervisors released model state regulatory prudential standards for nonbank mortgage servicers. MBA President and CEO Bob Broeksmit, CMB, immediately expressed support for the standards.

Category: News and Trends

CFPB: Rental Assistance Available as Eviction Moratorium Expiration Approaches

As the July 31 federal eviction moratorium expiration approaches, the Biden administration, Consumer Financial Protection Bureau, the Mortgage Bankers Association and industry groups are working together to inform apartment owners and renters about the rental assistance programs available to them.

Seth Appleton: How MISMO Standards Are Helping The Industry Achieve Higher Tech Adoption

At the recently concluded MISMO Spring Summit–which set an attendance record for the organization–two related themes emerged during many of the event’s “Going Digital” sessions. Experts throughout the four-day event agreed that technology adoption and data trust are two business challenges that must be solved so the industry can truly “go digital” and realize the benefits that come along with it.

Dealmaker: Marcus & Millichap Brokers Six Net-Leased Asset Sales for $29M

Marcus & Millichap, Calabasas, Calif., sold six single-tenant net-leased properties in New England for $28.7 million.

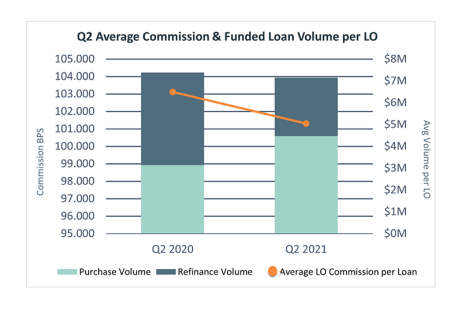

Mortgage Loan Compensation Report Shows Decline in LO Commissions, Volume

LBA Ware, Macon, Ga., said mortgage industry loan compensation per loan originator declined in the second quarter despite a marginal increase in loan volume from Q2 2020 to Q2 2021.

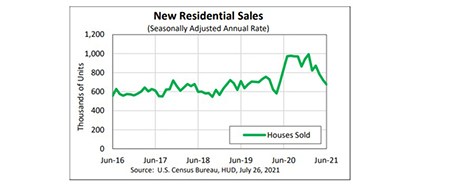

June New Home Sales Down 6.6%

June new home sales fell well below consensus expectations, HUD and the Census Bureau reported Monday, though analysts did not appear to be too worried by the results.

Key Takeaways from MBA Webinar: It’s a Wonderful Life Insurance Company Market

The Mortgage Bankers Association co-hosted a virtual panel with the California Mortgage Bankers Association and the American Council of Life Insurers on July 14. Five panelists represented firms with a variety of commercial real estate debt and equity strategies and buckets of capital including substantial life insurance company capital.

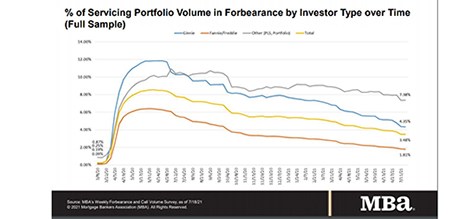

Share of Mortgage Loans in Forbearance Slightly Dips to 3.48%

Loans in forbearance fell for the 21st consecutive week, the Mortgage Bankers Association said on Monday.

MBA Weekly Applications Survey July 28, 2021: Apps Increase

Mortgage applications increased 5.7 percent from one week earlier, the Mortgage Bankers Association reported in its Weekly Mortgage Applications Survey for the week ending July 23, 2021.

FHA Establishes New, Streamlined COVID-19 Recovery Loss Mitigation Options

The Federal Housing Administration on Friday published Mortgagee Letter 2021-18, COVID-19 Recovery Loss Mitigation Options. The ML outlines assistance for homeowners who have been financially impacted by the COVID-19 pandemic to remain in their homes with new, streamlined loss mitigation options.