Inspire change; share success. The Mortgage Bankers Association recognizes residential and commercial/multifamily members who show leadership in the areas of Diversity, Equity and Inclusion (DEI) internally through market outreach efforts with its annual DEI Leadership Awards.

Category: News and Trends

Andrew Foster: Multifamily Values Amid a Shifting Landscape

The summer has brought big news for the housing industry including but not limited to multifamily market participants.

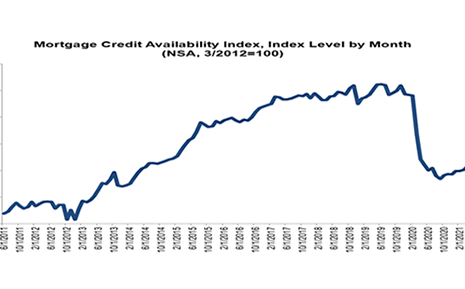

July Mortgage Credit Availability Increases Slightly

Mortgage credit availability increased slightly in July after a big drop in June, the Mortgage Bankers Association reported Thursday.

ICE: Purchases Eclipse Refinances for First Time in 18 Months

ICE Mortgage Technology, Pleasanton, Calif., reported new home purchases represented a higher percentage than refinances for the first time in nearly two years.

MBA: Second Quarter Commercial/Multifamily Borrowing Bounces Back

Commercial and multifamily mortgage loan originations jumped by 106 percent in the second quarter from a year ago and increased by 66 percent from the first quarter, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

Fitch: Return-to-Office Delays No Imminent Risk to Office REITs

Fitch Ratings, New York, said long-term office leasing plans will not likely be affected even if U.S. corporations continue to delay their return-to-office plans.

Dealmaker: NorthMarq Arranges $84M for Office, Industrial Assets

NorthMarq, Minneapolis, arranged $83.8 million for office and industrial properties in eight states.

MBA Opens Doors Foundation Welcomes Lennar Mortgage’s Laura Escobar to Board of Directors

The MBA Opens Doors Foundation welcomed Lennar Mortgage President Laura Escobar to its Board of Directors.

MBA CONVERGENCE Partner Profile: Sarah Garland of CBRE

Sarah Garland is Director of Production for Affordable Housing and FHA Lending with CBRE, Seattle, responsible for supporting the origination of affordable and workforce housing debt financing.

Quote

“Even as the economic recovery is underway, overall credit supply has remained close to its lowest levels since 2014. Some borrowers are still in pandemic-related forbearance status, and servicers continue to work through possible resolutions for these borrowers.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.