Registration for the Mortgage Bankers Association’s Annual Convention & Expo, taking place Oct. 17-20 at the San Diego Convention Center, is officially open. Join MBA in San Diego as New York Times best-selling authors Malcolm Gladwell and Brad Meltzer keynote General Sessions on Tuesday, Oct. 19.

Category: News and Trends

Call for Speakers: MBA Servicing Solutions Conference & Expo 2022—Deadline Sept. 13

Speaking proposals are now being accepted for the Mortgage Bankers Association’s Servicing Solutions Conference & Expo 2022, taking place February 22-25 in Orlando, Fla.

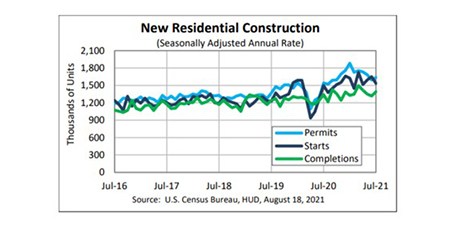

July Housing Starts Fall 7%

July housing starts fell by 7 percent, the Census Bureau reported yesterday, a disappointing result as home builders continue to be hamstrung by pipeline and labor shortages.

FHFA Raises Proposed 2022-2024 Housing Goals for Fannie Mae, Freddie Mac

Fannie Mae and Freddie Mac have new homework assignments from the Federal Housing Finance Agency, which raise the stakes considerably for the government-sponsored enterprises’ 2022-2024 affordable housing goals.

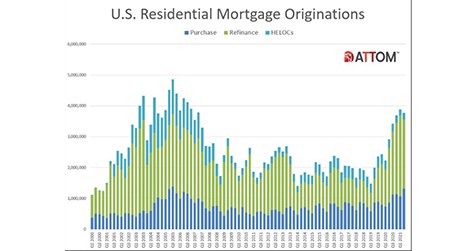

2Q Mortgage Lending Slows Amid Refi Retreat

The second quarter of any year is usually the strongest for mortgage lending, but not this past quarter, according to ATTOM, Irvine, Calif.

Retail Sales, Store Openings Could Boost Retail Property Loan Performance

Moody’s Investors Service, New York, said rebounding retail sales and new store openings should boost retail property loan performance.

Fewer Than 1 in 5 With Pre-Pandemic Mortgages Have Refinanced

Despite record low interest rates, just 19 percent of homeowners with a mortgage they had prior to the pandemic have refinanced since COVID-19 started, according to Bankrate.com.

Dealmaker: Oxford Properties Group To Buy KKR Industrial Portfolio for $2.2B

Oxford Properties Group, Toronto, agreed to acquire a 14.5-million-square-foot infill and light industrial portfolio from KKR, New York, for $2.2 billion.

MBA DEI Leadership Awards: Nomination Deadline Extended to Aug. 20

The Mortgage Bankers Association introduces a new offering to its members — the Diversity, Equity and Inclusion (DEI) Study — separately designed and compiled for both the residential and commercial/multifamily sides of the real estate finance industry.

Quote

“Both single-family and multifamily starts declined in July relative to June, but single-family starts remain almost 12% higher than last year. There are now almost 690,000 single-family homes under construction – the largest number since 2007. This is clearly a positive sign given the remarkably low levels of inventory on the market.”

–MBA Chief Economist Mike Fratantoni.