Existing home sales rose for the second straight month to their highest level since March, the National Association of Realtors reported Monday.

Category: News and Trends

Dealmaker: Gantry Secures $43M to Refinance Southern California Industrial Portfolio

Gantry, San Francisco, secured $43 million from a correspondent life company lender to refinance a four-building industrial portfolio for a 15-year term.

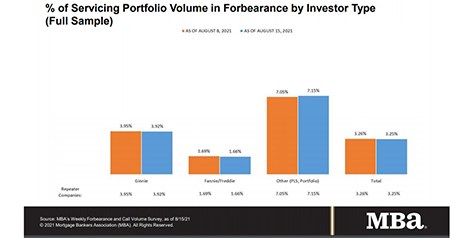

Share of Mortgage Loans in Forbearance Dips to 3.25%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 1 basis point to 3.25% of servicers’ portfolio volume as of August 15 from 3.26% the week prior. MBA estimates 1.6 million homeowners are in forbearance plans.

MBA CONVERGENCE Webinar Sept. 16–Mayors and Affordable Housing: Perspective from City Hall

MBA CONVERGENCE presents the next in its Webinar Series, Mayors and Affordable Housing: Perspective from City Hall, on Thursday, Sept. 16 from 1:30-2:15 p.m. ET.

Sponsored Content from Finastra: Consumers Are Buying, But Are You Providing the Mortgage?

Financial institutions are losing ground in the battle for mortgages. Learn what FIs could do to take back market share.

Quote

“The share of loans in forbearance was little changed this week, as both new requests and exits were at a slower pace compared to the prior week. In fact, exits were at their slowest pace in over a year.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

Joe Camerieri of Mortgage Cadence: How Analytics will Drive Success in Mortgage

Dealing effectively with a fast-changing market is only possible when data analysts can pull real business insight out of big pools of data. Fortunately, we have access to the technologies to help lenders get this job done.

Industry Briefs Aug. 24, 2021

Fannie Mae, Washington, D.C., revised its full-year 2021 real GDP growth forecast modestly downward due in part to the expectation that COVID-related disruptions to consumer spending and supply chains will more greatly hinder economic activity in the second half of the year than previously forecast.

MBA Advocacy Update Aug. 23 2021

On Wednesday, Senate Finance Committee Chairman Ron Wyden (D-OR) introduced a new bill that expands access to housing for first-time homebuyers and low-income individuals by investing in existing programs and establishing new tax credits geared toward renters and middle-income homeowners.

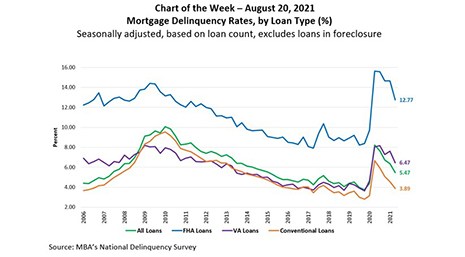

MBA Chart of the Week Aug. 23 2021: Mortgage Delinquency Rates, by Loan Type (%)

This week’s MBA Chart of the Week takes a look at mortgage delinquency rates by loan type (%) since 2006.