Josh Lehr is Director of Technology Alliances with Total Expert, Minneapolis, a fintech software company that built the first customer experience platform purpose-built for financial institutions.

Category: News and Trends

Quote

“The purchase index was at its highest level since early July, despite still continuing to lag 2020’s pace. There was also some easing in average loan sizes, which is potentially a sign that more first-time buyers looking for lower-priced homes are being helped by the recent uptick in for-sale inventory for both newly built homes and existing homes.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

Sponsored Content from Finastra: Consumers Are Buying, But Are You Providing the Mortgage?

Financial institutions are losing ground in the battle for mortgages. Learn what FIs could do to take back market share.

Joe Camerieri of Mortgage Cadence: How Analytics will Drive Success in Mortgage

Dealing effectively with a fast-changing market is only possible when data analysts can pull real business insight out of big pools of data. Fortunately, we have access to the technologies to help lenders get this job done.

MBA CONVERGENCE Webinar Sept. 16–Mayors and Affordable Housing: Perspective from City Hall

MBA CONVERGENCE presents the next in its Webinar Series, Mayors and Affordable Housing: Perspective from City Hall, on Thursday, Sept. 16 from 1:30-2:15 p.m. ET.

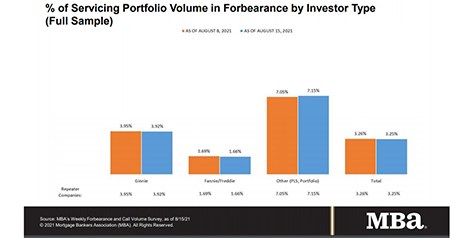

Share of Mortgage Loans in Forbearance Dips to 3.25%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 1 basis point to 3.25% of servicers’ portfolio volume as of August 15 from 3.26% the week prior. MBA estimates 1.6 million homeowners are in forbearance plans.

MBA Seeks Participants in New Diversity, Equity and Inclusion Study

The Mortgage Bankers Association introduces a new offering to its members — the Diversity, Equity and Inclusion (DEI) Study — separately designed and compiled for both the residential and commercial/multifamily sides of the real estate finance industry.

Authors Malcolm Gladwell, Brad Meltzer Keynote MBA Annual Convention & Expo

Registration for the Mortgage Bankers Association’s Annual Convention & Expo, taking place Oct. 17-20 at the San Diego Convention Center, is officially open. Join MBA in San Diego as New York Times best-selling authors Malcolm Gladwell and Brad Meltzer keynote General Sessions on Tuesday, Oct. 19.

Josh Lehr of Total Expert on How Data-Driven Communication Transcends Channels and Drives Lifetime Value

Josh Lehr is Director of Technology Alliances with Total Expert, Minneapolis, a fintech software company that built the first customer experience platform purpose-built for financial institutions.

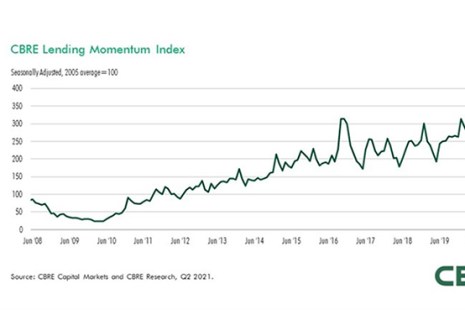

Commercial Real Estate Lending Markets Mirror Economic Recovery

CBRE, Dallas, reported commercial lending markets strengthened in the second quarter, mirroring the wider economic recovery.