Moody’s Analytics REIS, New York, said the office sector is unlikely to see a massive decline in demand for space and values per square foot due to increased hybrid work-from-home arrangements.

Category: News and Trends

Dealmaker: Axiom Capital Corp. Arranges $88M

Axiom Capital Corp., Clifton Park, N.Y., arranged $88.3 million in financing for retail and multifamily assets in Rhode Island and Connecticut.

Tim Anderson of Evolve Mortgage Services: Wide eMortgage Adoption Remains Elusive

Tim Anderson is EVP and Director of eMortgage Strategy for Evolve Mortgage Services, where he is responsible for overseeing deployment of the company’s end-to-end digital closing platform and developing strategic partner relationships.

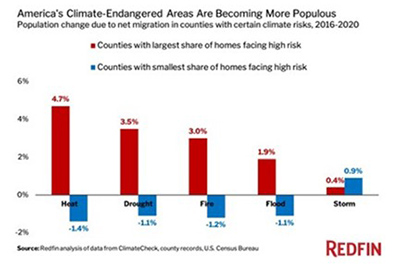

Climate Change? For Many Homebuyers, ‘Who Cares?’

The real estate industry is long-known for stories and anecdotes that seemingly defy logic—take, for example, the burnt-out home in San Francisco that last week drew a bidding war that pushed the final price above $1 million. Now, two separate reports show despite dire warnings about climate change, properties in some of the most vulnerable spots in the nation are actually attracting more interest—and higher prices.

People in the News August 26 2021

ChainLogix Mortgage Solutions, Fort Lauderdale, Fla., appointed Guadalupe Garcia as National Sales Executive, expanding the company’s West Coast presence.

MBA: IMB Profits Slow in 2nd Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $2,023 on each loan they originated in the second quarter, down from $3,361 per loan in the first quarter, the Mortgage Bankers Association reported Tuesday in its Quarterly Mortgage Bankers Performance Report.

Quote

“Even with better adoption of digital documents, obtaining the digital mortgage notarization piece has remained elusive. That’s partly because it has taken time for states to legalize RONs and partly because other closing providers haven’t figured out a way to easily integrate them into their solutions. So, while digital processes and eNote adoption has grown, we still have work to do to better streamline the overall process.”

–Tim Anderson, EVP and Director of eMortgage Strategy with Evolve Mortgage Services.

MBA Weekly Applications Survey Aug. 25, 2021: Purchases at Highest Level Since July

Mortgage applications increased from one week earlier as interest rates slid back toward 3 percent, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending August 20.

Industry Briefs Aug. 25, 2021: LRES Acquires Keystone Asset Management

LRES Corp., Orange, Calif., signed a definitive agreement to acquire Keystone Asset Management Inc., a Pennsylvania corporation. The deal is expected to be completed September 1, and the joined companies will operate under the LRES Corporation name.

Josh Lehr of Total Expert on How Data-Driven Communication Transcends Channels and Drives Lifetime Value

Josh Lehr is Director of Technology Alliances with Total Expert, Minneapolis, a fintech software company that built the first customer experience platform purpose-built for financial institutions.