For years, mortgage underwriters have been accustomed to working from home a few days a week; consequently, during the pandemic, it was not much of a challenge to transition to a 100% remote working scenario. What has been a challenge is managing these highly-skilled employees and maintaining their morale at the same time. The great news is that it can be done.

Category: News and Trends

Tim Anderson of Evolve Mortgage Services: Wide eMortgage Adoption Remains Elusive

Tim Anderson is EVP and Director of eMortgage Strategy for Evolve Mortgage Services, where he is responsible for overseeing deployment of the company’s end-to-end digital closing platform and developing strategic partner relationships.

MBA CONVERGENCE Webinar Sept. 16–Mayors and Affordable Housing: Perspective from City Hall

MBA CONVERGENCE presents the next in its Webinar Series, Mayors and Affordable Housing: Perspective from City Hall, on Thursday, Sept. 16 from 1:30-2:15 p.m. ET.

Radian: Home Price Appreciation Accelerates in July

Radian, Philadelphia, said after a strong finish to the first half of 2021, home prices across the United States rose at an even faster pace in July.

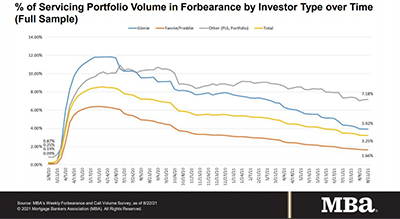

Share of Mortgage Loans in Forbearance Unchanged at 3.25%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance remained

unchanged at 3.25% as of August 22. MBA estimates 1.6 million homeowners are in forbearance plans.

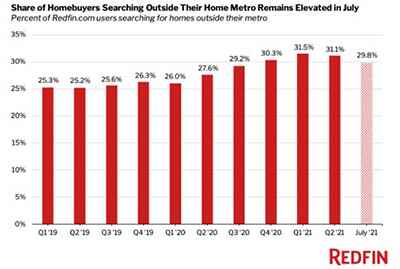

Migration of Homebuyers to Miami Triple Since Last Year

Last week saw two reports two reports that seemingly defied conventional wisdom—despite the very real effects of climate change, properties in some of the most vulnerable spots in the nation are actually attracting more interest—and higher prices. This week, another report shows Miami and other high-risk coastal areas continue to rank in the top 10 U.S. locations for net migration.

Data Centers Seeing Strong Growth

Data centers had a fantastic first half of 2021, with strong absorption delayed only by a lack of supply, reported Cushman & Wakefield, Chicago.

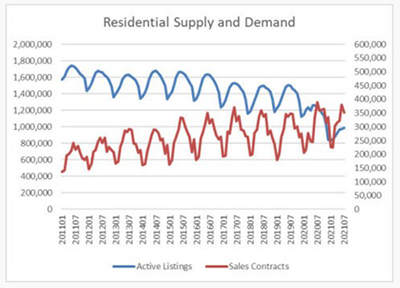

July Pending Home Sales Down 1.8%

Pending home sales dipped modestly in July, the National Association of Realtors said Monday, marking the second straight monthly downturn.

Commercial and Multifamily Briefs from KKR, JLL

KKR, New York, formed Strategic Lease Partners, a new platform to invest in triple-net lease real estate.

Dealmaker: Phillips Realty Capital Structures $58M for Florida Industrial Portfolio

Phillips Realty Capital, Bethesda, Md., closed a $57.5 million bridge loan for a four-property, 740,400-square-foot industrial portfolio in Miami and Tampa, Fla.