The Consumer Financial Protection Bureau on Wednesday proposed a new rule aimed at increasing transparency in the small business lending marketplace.

Category: News and Trends

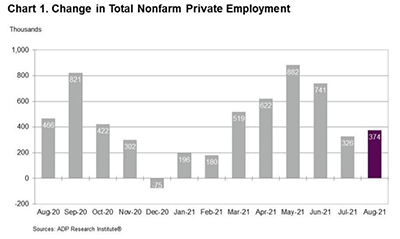

ADP: August Private-Sector Employment Up 374,000

In the first of three key snapshots of employment this week, ADP, Roseland, N.J., said private-sector employment increased by 374,000 jobs between July and August.

Administration Announces Steps to Increase Affordable Housing Supply

The Biden Administration on Wednesday announced a number of steps aimed at creating, preserving and selling to homeowners and non-profits nearly 100,000 additional affordable homes for homeowners and renters over the next three years, with an emphasis on the lower and middle segments of the market.

Quote

“MBA strongly supports the administration’s efforts to increase the housing supply by encouraging the construction and rehabilitation of affordable apartments and homes for renters and first-time buyers. The lack of supply is a huge problem, and HUD and FHFA should do what they can administratively while Congress considers more significant initiatives. MBA looks forward to continuing to work with the administration, Congress, and all other stakeholders on ways to address supply constraints and ensure government programs appropriately complement private capital to help both renters and homeowners.”

–MBA President and CEO Bob Broeksmit, CMB.

MBA Weekly Applications Survey Sept. 1, 2021: Refis Down, Purchases Up

With refinance applications and purchase applications moving in different directions, overall mortgage application activity fell last week as interest rates held steady, the Mortgage Bankers Association reported Wednesday in its Weekly Applications Survey for the week ending Aug. 27.

Data Identification and Governance: Updated FFIEC Examination Manual Booklet Indicates Higher Expectations by Financial Institution Examiners

On June 30, the Federal Financial Institutions Examination Council issued a new booklet. We identified critical guidelines from the new booklet that will introduce fresh challenges to your financial institution.

MBA CONVERGENCE Webinar Sept. 16–Mayors and Affordable Housing: Perspective from City Hall

MBA CONVERGENCE presents the next in its Webinar Series, Mayors and Affordable Housing: Perspective from City Hall, on Thursday, Sept. 16 from 1:30-2:15 p.m. ET.

Tim Anderson of Evolve Mortgage Services: Wide eMortgage Adoption Remains Elusive

Tim Anderson is EVP and Director of eMortgage Strategy for Evolve Mortgage Services, where he is responsible for overseeing deployment of the company’s end-to-end digital closing platform and developing strategic partner relationships.

Greer Allgood of Wipro Opus Risk Solutions: Managing Mortgage Underwriters Remotely

For years, mortgage underwriters have been accustomed to working from home a few days a week; consequently, during the pandemic, it was not much of a challenge to transition to a 100% remote working scenario. What has been a challenge is managing these highly-skilled employees and maintaining their morale at the same time. The great news is that it can be done.

MBA Weekly Applications Survey Sept. 1, 2021: Refis Down, Purchases Up

With refinance applications and purchase applications moving in different directions, overall mortgage application activity fell last week as interest rates held steady, the Mortgage Bankers Association reported Wednesday in its Weekly Applications Survey for the week ending Aug. 27.