MBA Education’s popular Certified Mortgage Compliance Professional certification and designation program recently awarded the CMCP designation to the first mortgage professional to complete all three levels of the program.

Category: News and Trends

MISMO Announces New PLS Dataset And Seeks Public Comment

MISMO®, the real estate finance industry standards organization, seeks public comment on its new standardized dataset, which facilitates the electronic exchange of mortgage asset data to credit rating agencies.

MBA Path to Diversity Scholarship Program Partner: USMI

The Mortgage Bankers Association’s Path to Diversity Scholarship Program recently gained an important partner in U.S. Mortgage Insurers, Washington, D.C. MBA NewsLink spoke with Lindsey Johnson, President of USMI, on how the company became involved with the Path to Diversity Scholarship Program.

Call for Speakers: MBA Servicing Solutions Conference & Expo 2022—Deadline Sept. 13

Speaking proposals are now being accepted for the Mortgage Bankers Association’s Servicing Solutions Conference & Expo 2022, taking place February 22-25 in Orlando, Fla.

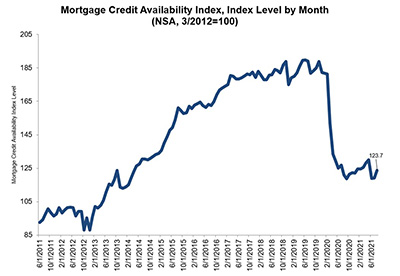

August Mortgage Credit Availability Up Nearly 4%

Mortgage credit availability increased by 3.9 percent in August, the Mortgage Bankers Association reported Thursday morning in its Mortgage Credit Availability Index.

MBA, Trade Groups, MAA Urge Congress to Support Section 1031 Like-Kind Exchanges, Industry Tax Priorities

Ahead of committee action in Congress this week on major infrastructure and economic legislation, the Mortgage Bankers Association and more than three dozen industry trade groups, as well as MBA’s grassroots advocacy arm, the Mortgage Action Alliance, urged senators and representatives to support and defend the real estate finance industry’s tax priorities.

Dealmaker: Paragon, Canyon Partners Acquire California Retail Center for $15M

Paragon Commercial Group LLC, El Segundo, Calif., and Canyon Partners Real Estate LLC, Los Angeles, acquired Village Center, a 92,400-square-foot shopping center in Orange County, Calif., for $14.8 million.

Fitch Ratings: Life Insurers Have Significant Commercial Mortgage Default Headroom

Fitch Ratings, New York, said potential stress on U.S. life insurers’ commercial mortgage portfolios will not drive rating downgrades, given the industry’s strong capitalization, current loan quality and historical loss experience.

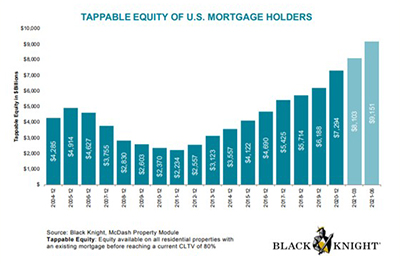

Black Knight: Tappable Equity Rises to Record-High $9.1 Trillion

Driven by the red-hot housing market, tappable equity – the amount available to homeowners before reaching a maximum 80% combined loan-to-value ratio – surged nearly 40% from last year to a record $9.1 trillion in the second quarter, said Black Knight, Jacksonville, Fla.

‘Zombie’ Properties Decline as Foreclosure Moratorium Lifts

ATTOM, Irvine, Calif., issued its third-quarter Vacant Property and Zombie Foreclosure Report showing 1.3 million residential properties in the United States sit vacant.