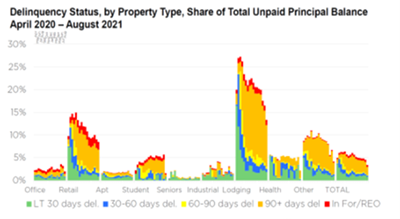

Delinquency rates of mortgages backed by commercial and multifamily properties have broadly improved in recent months, according to two new Mortgage Bankers Association reports.

Category: News and Trends

Sponsored Content from WFG: MBA Reports of Falling Per-Loan Profits Prompt Calls for Greater Efficiencies

On Aug. 30, Mortgage Professional America reported “Independent mortgage banks and mortgage subsidiaries of chartered banks reported hefty declines in their profit in the second quarter of 2021.”

mPowering You: MBA’s Summit for Women in Real Estate Finance Oct. 16

mPowering You, MBA’s Summit for Women in Real Estate Finance, takes place Saturday, Oct. 16 at the San Diego Convention Center just ahead of the MBA Annual Convention & Expo (Oct. 17-20).

Sponsored Content from WFG: MBA Reports of Falling Per-Loan Profits Prompt Calls for Greater Efficiencies

On Aug. 30, Mortgage Professional America reported “Independent mortgage banks and mortgage subsidiaries of chartered banks reported hefty declines in their profit in the second quarter of 2021.”

Authors Malcolm Gladwell, Brad Meltzer Keynote MBA Annual Convention & Expo

Registration for the Mortgage Bankers Association’s Annual Convention & Expo, taking place Oct. 17-20 at the San Diego Convention Center, is officially open. Join MBA in San Diego as New York Times best-selling authors Malcolm Gladwell and Brad Meltzer keynote General Sessions.

Joe Puthur of Mortgage Coach: Fair Lending Compliance is a Competitive Advantage

Strengthening mortgage accessibility industry-wide is not a burden, but an opportunity that should be embraced. Every qualified loan is good business and new affordability goals and programs instantly broaden the marketplace of eligible buyers.

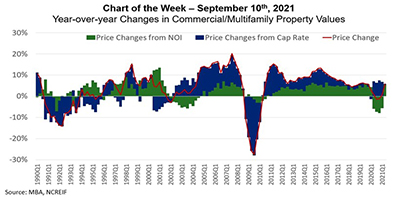

MBA Chart of the Week Sept. 10 2021–Commercial/Multifamily Property Values

Commercial and multifamily property prices are the product of two things: a) the net operating income (NOI) a property produces and/or is expected to produce and b) the multiple of that income (the capitalization or “cap” rate) investors are willing to pay in order to own that income stream.

MBA Advocacy Update Sept. 13, 2021

On Thursday, five House committees, including the House Ways and Means Committee, began to consider their respective reconciliation bills as a non-binding September 15 deadline approaches. Also last week, the Federal Housing Finance Agency announced the GSEs will submit Equitable Housing Finance Plans that will identify and address barriers to sustainable housing opportunities.

Quote

“I’m proud to say that the housing industry has resumed its rightful role as an engine, leading the economy out of recession, rather than what happened during the Great Financial Crisis.”

–MBA President & CEO Robert Broeksmit, CMB, addressing the MBA Regulatory Compliance Conference in Washington.

Copy of Sponsored Content from WFG: MBA Reports of Falling Per-Loan Profits Prompt Calls for Greater Efficiencies

With its midyear 2021 revenue signaling another record year, WFG shares what drives its own product roadmap for lenders.