Partnership will deliver first-ever centralized repository for digital closing acceptance criteria to help lenders more easily adopt digital mortgage closings

Category: News and Trends

August Apartment Market Performance Surges

August set records for U.S. apartment rent growth and occupancy, reported RealPage, Richardson, Texas

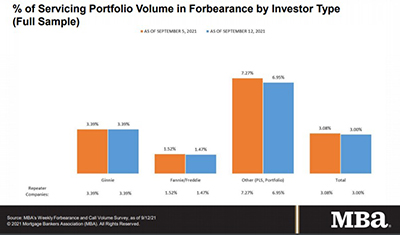

Share of Mortgage Loans in Forbearance Falls to 3.00%

Mortgage loans in forbearance fell to yet another post-pandemic low and threatened to fall under 3 percent for the first time in more than a year and a half, the Mortgage Bankers Association reported on Monday.

Dealmaker: George Smith Partners Secures $45M

George Smith Partners, Los Angeles, arranged two take-out loans totaling $45.4 million for flex and industrial properties in Los Angeles and Austin, Texas.

Brian Vieaux of AXIS Lending Academy: Diversity is Key to Success in Real Estate Finance

Brian Vieaux is a director of AXIS Lending Academy. He is also the president and COO of FinLocker, a provider of next-generation, digital, consumer-permissioned personal financial assistance tools. He has three decades of home lending experience and has held leadership roles at Citigroup, Flagstar and IndyMac Bank.

Builder Confidence Steadies as Material, Labor Challenges Persist

The National Association of Home Builders reported builder confidence inched up in September on lower lumber prices and strong housing demand, even as the housing sector continues to grapple with building material supply chain issues and labor challenges.

Housing Market Roundup Sept. 21, 2021

It’s another busy week for housing reports—and it’s only Tuesday! Here are some reports of interest that crossed the MBA NewsLink desk:

MBA Announces Policy Initiative to Close Racial Homeownership Gap

The Mortgage Bankers Association on Monday announced a policy initiative, Building Generational Wealth Through Homeownership, aimed at providing industry leadership and direction for reducing the racial homeownership gap, developing and supporting policies that support sustainable homeownership for communities of color and promoting fair, equitable and responsible lending for minority borrowers.

MBA Announces Policy Initiative to Close Racial Homeownership Gap

The Mortgage Bankers Association on Monday announced a policy initiative, Building Generational Wealth Through Homeownership, aimed at providing industry leadership and direction for reducing the racial homeownership gap, developing and supporting policies that support sustainable homeownership for communities of color and promoting fair, equitable and responsible lending for minority borrowers.

Quote

“MBA’s new policy initiative serves as a perfect foundation to level the playing field. The mortgage industry has a responsibility to promote minority homeownership by partnering with key stakeholders to remove barriers and support financial education and counseling, with a goal to close the racial homeownership gap and increase generational wealth among minority households.”

–Susan Stewart, 2021 MBA Chair and CEO of SWBC Mortgage Corp. San Antonio, Texas.