Partnership will deliver first-ever centralized repository for digital closing acceptance criteria to help lenders more easily adopt digital mortgage closings

Category: News and Trends

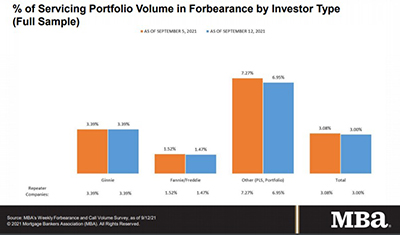

Share of Mortgage Loans in Forbearance Falls to 3.00%

Mortgage loans in forbearance fell to yet another post-pandemic low and threatened to fall under 3 percent for the first time in more than a year and a half, the Mortgage Bankers Association reported on Monday.

Brian Vieaux of AXIS Lending Academy: Diversity is Key to Success in Real Estate Finance

Brian Vieaux is a director of AXIS Lending Academy. He is also the president and COO of FinLocker, a provider of next-generation, digital, consumer-permissioned personal financial assistance tools. He has three decades of home lending experience and has held leadership roles at Citigroup, Flagstar and IndyMac Bank.

Quote

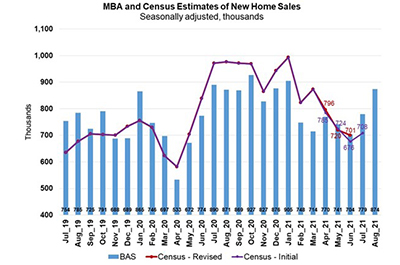

“Housing demand is strong heading into the fall, despite fast-rising home prices and low inventory. The inventory situation is improving, with more new homes under construction and more homeowners listing their home for sale.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

MBA Announces Policy Initiative to Close Racial Homeownership Gap

The Mortgage Bankers Association on Monday announced a policy initiative, Building Generational Wealth Through Homeownership, aimed at providing industry leadership and direction for reducing the racial homeownership gap, developing and supporting policies that support sustainable homeownership for communities of color and promoting fair, equitable and responsible lending for minority borrowers.

MBA CONVERGENCE Partner Profile: David Dworkin, National Housing Conference

One in a recurring series about MBA CONVERGENCE, the Mortgage Bankers Association’s affordable housing initiative.

Armand Massie of HCL Technologies: Transforming Lending Solutions for Enhanced Customer Experience

The face of lending has changed – from large banks and financial institutions to online consumers and lenders. With the pandemic mandating social distancing and lockdowns, businesses and individuals are looking for lenders that can perform the borrowing journey remotely and faster than before.

State of Construction Finance: An Interview with Rabbet CEO Will Mitchell

Rabbet, Austin, Texas, a service provider to lenders and developers engaged in construction recently released its 2021 State of Construction Finance report. MBA Newslink interviewed Rabbet CEO Will Mitchell to get a sense of what’s happening in the world of construction.

Andrew Peters and Sonny Abbasi of Lenderworks: Growing Your Business and Staying Compliant in a Changing Landscape

The likelihood of more aggressive federal enforcement is of special concern to smaller, growing mortgage lenders.

MBA: August New Home Applications Up 9% From July, Down 17% from Year Ago

The Mortgage Bankers Association’s latest Builder Applications Survey reported mortgage applications for new home purchases increased by 9 percent in August from July but decreased by 17 percent from a year ago.