The Consumer Financial Protection Bureau released a report warning that millions of renters and their families may suffer previously avoided economic harms of the COVID-19 pandemic as federal and state relief programs end.

Category: News and Trends

Todd Sheinin of Homespire Mortgage: The Future of the Mortgage Office–Redefining the Workplace in a Post-Vaccine Environment

With the effects of the pandemic now stretching into a second year, many mortgage companies are beginning to feel the pressure to have employees return to the office. However, while returning may seem like the right move on the surface, it is important to consider the reasoning behind this decision and whether it is completely necessary.

Mark P. Dangelo: The Dark Matter Transforming M&A Post-Deal Landscapes, Part 3

Data is the “dark matter” of M&A events. Data is made even more important with widespread digital transformations of processes, predictive analytics, and advanced machine learning. During an M&A event, the cascading challenges to leverage these siloed data innovations across Industry 4.0 ecosystems requires a framework that moves beyond the prescriptive, one-size-fits-all strategy.

Home Affordability Slips Again

ATTOM, Irvine, Calif., reported median-priced single-family homes are less affordable compared to historical averages in 75 percent of counties across the nation with enough data to analyze.

Affordable Housing Vacancy Rates Remain Tight

The national vacancy rate for Low-Income Housing Tax Credit-supported affordable housing dipped 0.1 percent in the second quarter to 2.5 percent, said Moody’s Analytics REIS, New York.

Industry Briefs Sept. 24, 2021: CFPB Says Renters at Risk as COVID Safety Net Ends

The Consumer Financial Protection Bureau released a report warning that millions of renters and their families may suffer previously avoided economic harms of the COVID-19 pandemic as federal and state relief programs end.

Dealmaker: Bellwether Enterprise Closes $35M in Loan Deals for Affordable Housing

Bellwether Enterprise Real Estate Capital LLC, Cleveland, closed three loans totaling $35.3 million for affordable multifamily housing in Kingsport, Tenn., Baltimore and Indianapolis.

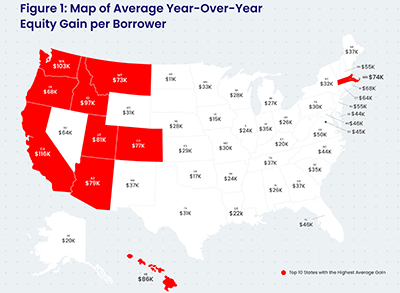

CoreLogic: Homeowners Gained $2.9 Trillion in Equity in Q2

CoreLogic, Irvine, Calif., said homeowners with mortgages saw their equity increase by 29.3% year over year, representing a collective equity gain of more than $2.9 trillion and an average gain of $51,500 per borrower over the past year.

MISMO Fall Summit: Building Confidence and Efficiency into Non-Agency Data Exchanges

CRYSTAL CITY, VA.–An efficient private-label securities market requires that investors have confidence in their understanding of asset quality for their deals. But questions remain, according to panelists here at the MISMO Fall Summit–and ongoing work under the auspices of MISMO is poised to help provide much-needed data standardization.

Multifamily Market Musings: a Conversation with Fannie Mae’s Kim Betancourt

Kim Betancourt is Fannie Mae’s Senior Director of Economics and Multifamily Research. She manages a team of real estate economists that focus exclusively on the multifamily sector.