With the effects of the pandemic now stretching into a second year, many mortgage companies are beginning to feel the pressure to have employees return to the office. However, while returning may seem like the right move on the surface, it is important to consider the reasoning behind this decision and whether it is completely necessary.

Category: News and Trends

Sponsored Content from InRule: Transform Mortgage Lending and Real Estate with Machine Learning

Discover five common scenarios in mortgage lending to help your enterprise get started with machine learning.

Innovations Drive Retail Resurgence

The pandemic and market pressures are forcing the retail sector to innovate, reported Colliers, Toronto.

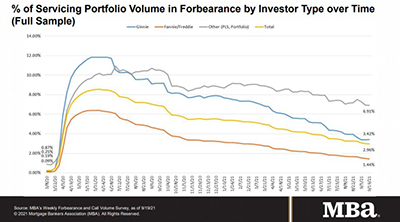

MBA: Loans in Forbearance Fall Under 3%

Loans in forbearance fell to under 3 percent for the first time since March 2020, the Mortgage Bankers Association reported Monday.

Dealmaker: Blackstone Sells The Cosmopolitan of Las Vegas for $5.6B

Blackstone Real Estate Partners VII LP, New York, agreed to sell The Cosmopolitan of Las Vegas for $5.65 billion.

Housing Market Roundup Sept. 28, 2021

Here’s a roundup of recent housing reports that have come across the MBA NewsLink desk:

People in the News Sept. 28, 2021

CBRE, Dallas, appointed Rachel Vinson as Global Chief Operating Officer for Capital Markets. She lead the operations of CBRE’s global Capital Markets business, consisting of Property Sales, Debt & Structured Finance and Capital Advisors—the firm’s investment banking division.

Louis Casari of HCL Technologies: Leveraging Hyperautomation Lending Solutions to Accelerate Business Growth

By combining multiple advanced technologies such as machine learning and RPA, businesses are innovating their workflows. Lending solutions is a prime area where hyperautomation can deliver significant benefits and accelerate the speed of growth.

Sponsored Content from InRule: Transform Mortgage Lending and Real Estate with Machine Learning

Discover five common scenarios in mortgage lending to help your enterprise get started with machine learning.

MBA Advocacy Update Sept. 24, 2021

On Tuesday, House lawmakers passed a continuing resolution along party lines, sending the measure to the Senate for a vote ahead of a Sept. 30 government funding deadline. Meanwhile, MBA led a coalition of associations urging Congress to raise the federal debt limit to avoid roiling financial markets. And MBA’s Research Institute for Housing America released a report that examines climate change’s growing impact on housing and housing finance.