WASHINGTON, D.C.–Risk managers worked hard to maintain operations, employee morale and productivity when the pandemic hit, top risk management executives said during the recent Mortgage Bankers Association Risk Management, QA and Fraud Prevention Forum 2021.

Category: News and Trends

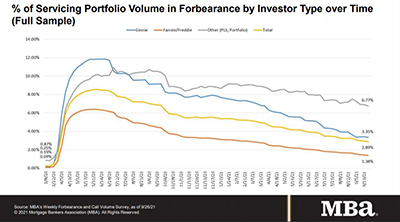

Share of Mortgage Loans in Forbearance Decreases to 2.89%

Loans in forbearance continued their downward trend, the Mortgage Bankers Association reported Monday, and the number of homeowners in forbearance plans fell below 1.5 million.

Net Lease Sector Cap Rates Reach New Lows

The Boulder Group, Wilmette, Ill., said single-tenant net lease cap rates fell to new lows for all three asset classes in the third quarter.

Dealmaker: Merchants Capital Provides $18M for California Affordable Housing

Merchants Capital, Carmel, Ind., provided $18.2 million to Eden Housing to rehabilitate two California affordable housing communities: Emerson Arms and Arroyo Vista.

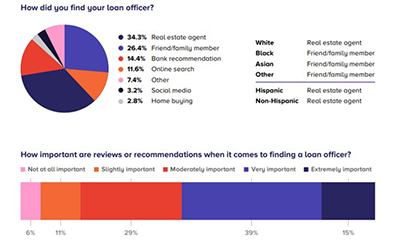

MBA Sponsors 2021 NextGen Homebuyer Report on Consumer Behaviors, Trends

In collaboration with the Mortgage Bankers Association and National MI, Cultural Outreach released the 2021 NextGen Homebuyer Report, which sheds light on the consumer behavior of the largest growing demographic of homebuyers, including insight into the financial behavior and perspectives of a young generation in the midst of a pandemic.

Student Housing Trends: A Q&A with JLL

MBA NewsLink interviewed JLL Capital Markets Senior Director Teddy Leatherman and JLL Valuation Advisory Senior Vice President Kai Pan about the current state of the student housing market and what might be in store for the sector.

MBA Advocacy Update Oct. 4 2021

On Thursday, House and Senate lawmakers passed, and President Joe Biden signed, a continuing resolution ahead of the Sept. 30 government funding deadline to avert a shutdown. Also on Thursday, the Senate voted 50-48 to confirm Rohit Chopra as the next CFPB Director.

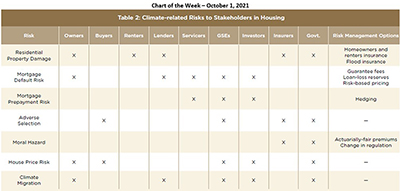

MBA Chart of the Week Oct. 4, 2021

This week’s MBA Chart of the Week lists risks that will likely increase or change because of climate change along with an indication of impacted stakeholders.

Quote

“While 1.4 million homeowners remained in forbearance as of September 26, this number is expected to drop sharply over the next few weeks as many are reaching the 18-month expiration point of their forbearance terms. Most borrowers exiting forbearance through a workout are opting for a deferral plan, which allows them to resume their original payment, while moving the forborne amount to the end of the loan.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

RMQA21 Fraud Update: ‘Be Alert For Red Flags’

WASHINGTON, D.C.–The mortgage industry needs to be prepared for increased fraud activity as the pandemic and the recession fade, law enforcement, legal and mortgage servicing analysts said at the recent Mortgage Bankers Association’s Risk Management, QA and Fraud Prevention Forum 2021.