We realize this year’s Annual agenda is chock full of great content, social opportunities and dazzling entertainment. Even so, we hope you will venture out a bit to explore the sights, sounds and vibe of California’s second largest city.

Category: News and Trends

Pivoting Again: MBA ANNUAL21 Returns MBA to Live Meetings

It’s time to shake hands, pat backs and smile at each other—while observing COVID protocols, of course!

MBA Annual21 Sponsors

The Mortgage Bankers Association thanks the following companies for their sponsorship of the MBA Annual Convention & Expo:

Together Again…Safely

For the first time in two years, the Mortgage Bankers Association’s Annual Convention & Expo is taking place in person, October 17-20 in San Diego. MBA is committed to creating a healthy and safe environment for all attendees.

MBA Annual Convention Breakout Sessions

Breakout sessions are the lifeblood of the Mortgage Bankers Association’s Annual Convention & Expo. These sessions provide in-the-weeds discussions and insights from expert panelists on the most relevant topics to your business in these challenging times.

MBA Annual21: Schedule at a Glance—General Sessions/Special Events

Here’s a handy guide to keynote sessions at MBA Annual21, taking place Oct. 17-20 at the San Diego Convention Center. For more information, visit the Convention website.

Welcome to Our Preview of MBA Annual21

The Mortgage Bankers Association’s Annual Convention & Expo (MBA Annual21) is back—and better than ever—at the San Diego Convention Center Oct. 17-20.

MBA Advocacy Update Oct. 11, 2021

On Thursday, the Senate Banking Committee held a nomination hearing for Alanna McCargo to be President of Ginnie Mae. Earlier last week, HUD issued an advance notice of proposed rulemaking on its process for transitioning away from the use of LIBOR for FHA-insured ARMs. And late Thursday, congressional leaders reached agreement to temporarily raise the statutory federal debt limit.

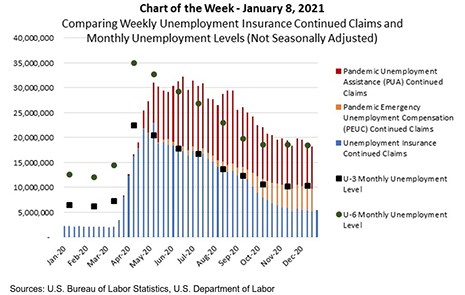

MBA Chart of the Week Oct. 11, 2021–Monthly Payroll Growth

Friday’s Employment Situation Summary from the U.S. Bureau of Labor Statistics indicated that job growth remained lackluster in September following similarly disappointing gains in August.

Quote

“Payment performance has remained steady for those who have exited forbearance and into a workout since 2020, with more than 85% of those borrowers current as of October. It also continues to be striking that so many homeowners in forbearance have continued to make their payments. Almost 16 percent of borrowers in forbearance as of October 3rd were current.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.