Dave Parker is Chief Product Officer for LoanLogics, a Jacksonville, Fla.-based provider of loan quality technology for mortgage manufacturing and loan acquisition.

Category: News and Trends

Jim Freeman of Fiserv: Mortgage Magic in Thinking Big

The truth is, there is magic in thinking big, especially for the mortgage industry and especially now. In fact, viewing the industry with a new perspective can only benefit lenders in this changing market.

Paul Gigliotti of AXIS Lending Academy: How Diversity Efforts Can Reach Critical Mass

Our own industry has embraced diversity, equity and inclusion efforts at a rapid rate over the past several years. At the same time, we only have to look around ourselves to see that we still have a long way to go, especially at the leadership and boardroom level.

Freddie Mac: Single Women Have Low Confidence in Homeownership Prospects

Freddie Mac, McLean, Va., reported nearly 60 percent of single female head-of-household renters feel homeownership is out of reach indefinitely.

Quote

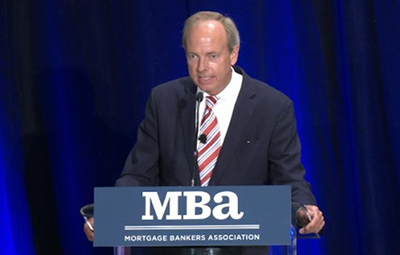

“More newly built homes and more homeowners listing their homes for sale should lead to some deceleration in home-price growth next year. This is good news for the many would-be buyers who are currently priced out or delaying decisions because of low supply conditions and steep home-price appreciation.”

–MBA Chief Economist Mike Fratantoni.

Stanley Middleman of Freedom Mortgage: Let’s Use What We Learned from Past Housing Mistakes

We must remember to encourage people to buy homes they can afford and educate them on the costs that go with owning a home. That includes advising consumers not to borrow as much money as they possibly can, lest they become “house poor” and miss out on being able to create a more financially secure future for themselves and their families.

Kristy Fercho Takes Charge

This weekend, when the Mortgage Bankers Association convenes in San Diego for its Annual Convention & Expo, it will install Kristy Williams Fercho as its first Black Chairman and only its fourth female to hold the position.

Sponsored Content from FICS: The ABCs of Mortgage Software APIs

Application programming interfaces (APIs) help lenders and servicers automate mortgage operations and improve borrower communication.

10 Fun Things to do While in Beautiful, Sunny San Diego

We realize this year’s Annual agenda is chock full of great content, social opportunities and dazzling entertainment. Even so, we hope you will venture out a bit to explore the sights, sounds and vibe of California’s second largest city.

MBA Annual21: Schedule at a Glance—General Sessions/Special Events

Here’s a handy guide to keynote sessions at MBA Annual21, taking place Oct. 17-20 at the San Diego Convention Center. For more information, visit the Convention website.