The truth is, there is magic in thinking big, especially for the mortgage industry and especially now. In fact, viewing the industry with a new perspective can only benefit lenders in this changing market.

Category: News and Trends

JLL Construction Outlook: Material, Labor Availability Constrain Recovery

JLL, Chicago, said the construction industry has weathered the past 18 months well by most measures, but challenges remain.

MBA Forecast: 2022 Purchase Originations to Increase 9% to Record $1.7 Trillion

SAN DIEGO–The Mortgage Bankers Association said purchase mortgage originations are expected to grow 9% to a record $1.725 trillion in 2022.

MBA Elects 2022 Board of Directors

SAN DIEGO—The Mortgage Bankers Association on Sunday swore in its Board of Directors for the 2022 membership year at its 2021 Annual Convention & Expo.

MBA Elects 2022 Officers: Kristy Fercho, Matt Rocco, Mark Jones

SAN DIEGO—The Mortgage Bankers Association swore in Kristy Fercho, Executive Vice President and Head of Home Lending with Wells Fargo, as MBA 2022 Chairman on Sunday during the association’s 2021 Annual Convention & Expo.

MBA Appoints 2022 Residential Board of Governors

SAN DIEGO—The Mortgage Bankers Association announced members of its 2022 Residential Board of Governors (RESBOG) and chairs of its Residential Committees.

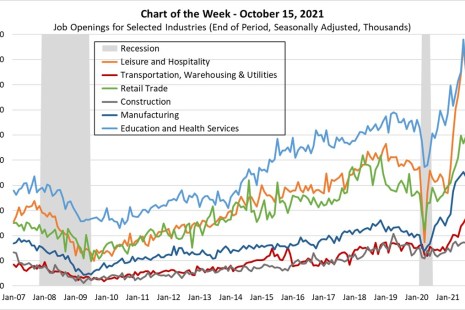

MBA Chart of the Week Oct. 18, 2021–Job Openings for Selected Industries

The U.S. Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS) data for August continues to show that many employers are running into difficulty re-hiring and filling open positions.

Quote

“Right now, I’m able to say, ‘I’m the only one of me,’ and that’s not a good thing. We need to do more to build a pipeline of talent so that in five years, we have more people from diverse backgrounds– not only in leadership, but at every level. It’s the right thing to do– and this is the right time.”

–MBA Chairman Kristy Fercho.

MBA Appoints 2022 Residential Board of Governors

SAN DIEGO—The Mortgage Bankers Association announced members of its 2022 Residential Board of Governors (RESBOG) and chairs of its Residential Committees.

Today at MBA Annual21

SAN DIEGO—MBA Annual21, the Mortgage Bankers Association’s Annual Convention & Expo, kicks off in earnest this morning with a full slate of keynote addresses, general sessions, breakout sessions and special events.