SAN DIEGO—On the fifth anniversary of mPower’s first event here, Mortgage Bankers Association Chief Operating Officer and mPower founder Marcia M. Davies reflected on a tumultuous—and rewarding—period for women in the real estate finance industry.

Category: News and Trends

mPowering You: MBA Leaders Take the Stage

SAN DIEGO–mPowering You: MBA’s Summit for Women in Real Estate Finance, put together a unique and powerful panel—the only four women in MBA’s 108-year history to serve as Chairman of the Mortgage Bankers Association.

Tomorrow at MBA Annual21

SAN DIEGO—MBA Annual21, the Mortgage Bankers Association’s Annual Convention & Expo, concludes Wednesday morning.

Brent Chandler of FormFree: the Business Case for Jumping on the Rent Payment History Bandwagon

The case for considering a mortgage loan applicant’s rent history is compelling. Limited credit history disqualifies many renters ― even those with great rent payment history — from homeownership, and multiple studies confirm that factoring in rent payment history typically increases credit scores.

MBA Recognizes 48 New Certified Mortgage Banker Graduates

SAN DIEGO—MBA Education, the award-winning education division of the Mortgage Bankers Association, recognized 48 individuals who earned the Certified Mortgage Banker (CMB®) designation at a ceremony held during its 2021 Annual Convention & Expo.

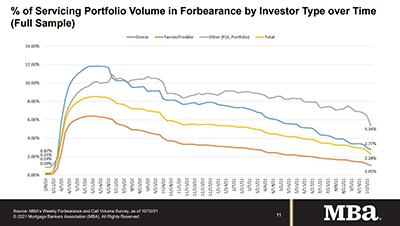

Share of Mortgage Loans in Forbearance Decreases to 2.28%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 34 basis points to 2.28% as of October 10.

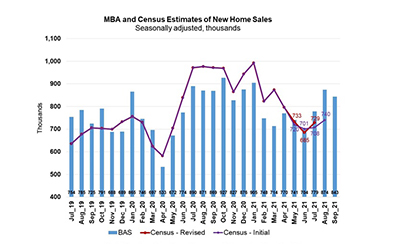

September New Home Purchase Mortgage Applications Down 16.2%

Mortgage applications for new home purchases decreased 16.2 percent from a year ago, the Mortgage Bankers Association reported Tuesday in its September Builder Applications Survey. From August, applications decreased by 4 percent.

Rajesh Bhat of Roostify: When Will the Mortgage Industry be Truly Automated?

The mortgage industry has been moving towards automation, but still has a long and complex road ahead. Rajesh Bhat, Co-Founder and CEO of Roostify, offers his perspective on what steps lenders can take today to better prepare themselves for the journey, and the destination.

Quote

“When I think of the mPower community, I think of how we can continue to support each other. Helping each other in good times and bad, supporting each other through thick and thin and loving each other when the going gets rough.”

–MBA Chief Operating Officer and mPower Founder Marcia Davies.

People in the News Oct. 19, 2021

VantageScore Solutions LLC, Stamford, Conn., named Silvio Tavares President and CEO and said Barrett Burns, founding President and CEO of VantageScore, has transitioned to a newly created position of Vice Chairman.