Alliant Credit Union, Chicago, closed $51 million in financing for three student housing properties located near Louisiana State University, Baylor University and the University of Tennessee, Knoxville.

Category: News and Trends

MBA Weekly Applications Survey Oct. 20, 2021: Applications Decrease

Mortgage applications decreased 6.3 percent from one week earlier, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending October 15, 2021.

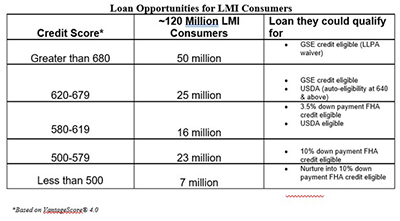

TransUnion: LMI Consumers Present $300 Billion Growth Opportunity for Mortgage Industry

Low-to-moderate income consumers have traditionally been overlooked in the mortgage market and trail non-LMI consumers in terms of homeownership. A new study from TransUnion, Chicago, suggests closing this gap could yield mortgage lenders as much as ~$300 billion in refinance and purchase originations.

mPowering You: Looking Ahead—Knowing Your Value and Asking for What You Want

SAN DIEGO—After 18 months as the country and businesses return to normal, what is the new normal in the workplace?

Brent Chandler of FormFree: the Business Case for Jumping on the Rent Payment History Bandwagon

The case for considering a mortgage loan applicant’s rent history is compelling. Limited credit history disqualifies many renters ― even those with great rent payment history — from homeownership, and multiple studies confirm that factoring in rent payment history typically increases credit scores.

Paul Gigliotti of AXIS Lending Academy: How Diversity Efforts Can Reach Critical Mass

Our own industry has embraced diversity, equity and inclusion efforts at a rapid rate over the past several years. At the same time, we only have to look around ourselves to see that we still have a long way to go, especially at the leadership and boardroom level.

Rajesh Bhat of Roostify: When Will the Mortgage Industry be Truly Automated?

The mortgage industry has been moving towards automation, but still has a long and complex road ahead. Rajesh Bhat, Co-Founder and CEO of Roostify, offers his perspective on what steps lenders can take today to better prepare themselves for the journey, and the destination.

Quote

“Data is key going forward. The shift from refi to purchase is a matter of getting your head in the right space, and getting your employees focused so that they don’t get burnt out. We’re looking ahead to what we’re going to do a year from now or two years from now.”

–Susan Stewart, CEO of SWBC Mortgage, San Antonio, Texas, and immediate Past MBA Chairman.

MBA Weekly Applications Survey Oct. 20, 2021: Applications Decrease

Mortgage applications decreased 6.3 percent from one week earlier, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending October 15, 2021.

mPowering You: Four New Rules of Success in Today’s New Work Environment

SAN DIEGO—On the fifth anniversary of mPower’s first event here, Mortgage Bankers Association Chief Operating Officer and mPower founder Marcia M. Davies reflected on a tumultuous—and rewarding—period for women in the real estate finance industry.