Chris Meade is Vice President of Client Relations of LenderClose, a fintech engaged in providing technology platforms to home equity and real estate lenders. With more than 10 years of experience in the technology industry, he seeks to build and enrich client relationships with a personable and user-centric approach.

Category: News and Trends

Industry Briefs Oct. 22, 2021: Clarifire Partners with Freddie Mac on Streamlined Servicing Workouts

Clarifire, St. Petersburg, Fla., announced its CLARIFIRE workflow automation application has gone live with Resolve, Freddie Mac’s new integrated default management platform.

Rajesh Bhat of Roostify: When Will the Mortgage Industry be Truly Automated?

The mortgage industry has been moving towards automation, but still has a long and complex road ahead. Rajesh Bhat, Co-Founder and CEO of Roostify, offers his perspective on what steps lenders can take today to better prepare themselves for the journey, and the destination.

Brent Chandler of FormFree: the Business Case for Jumping on the Rent Payment History Bandwagon

The case for considering a mortgage loan applicant’s rent history is compelling. Limited credit history disqualifies many renters ― even those with great rent payment history — from homeownership, and multiple studies confirm that factoring in rent payment history typically increases credit scores.

Perspectives from the C-Suite: Executives Discuss Top Industry Issues

SAN DIEGO—There’s a lot going on with the mortgage industry right now—post-pandemic operations; regulatory changes; housing affordability; diversity, equity and inclusion. What better way to gain perspective on these issues than asking several top-level industry executives what they’re seeing?

Chris Meade of Lender Close: The Right Stuff–How the Right Technology Can Unlock Real Estate and Home Equity Lending

Chris Meade is Vice President of Client Relations of LenderClose, a fintech engaged in providing technology platforms to home equity and real estate lenders. With more than 10 years of experience in the technology industry, he seeks to build and enrich client relationships with a personable and user-centric approach.

mPowering You: Accelerating Gender and Racial Equity

SAN DIEGO—Ishanaa Rambachan, a partner with McKinsey & Co., puts things bluntly: “This is one of the most tumultuous times to be a woman in the workplace.”

Industry Briefs Oct. 21, 2021: Clarifire Partners with Freddie Mac on Streamlined Servicing Workouts

Clarifire, St. Petersburg, Fla., announced its CLARIFIRE workflow automation application has gone live with Resolve, Freddie Mac’s new integrated default management platform.

MBA Education Honors Daniel Jensen with Willis Bryant Award

MBA Education, the award-winning education division of the Mortgage Bankers Association, honored Federal Housing Finance Agency Office of the Inspector General’s Daniel Jensen with its Willis Bryant Award.

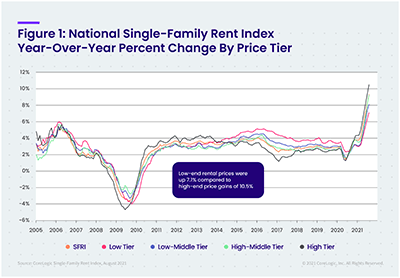

Single-Family Rent Prices Near Double-Digit Growth in August

CoreLogic, Irvine, Calif., reported rents for single-family rental properties increased 9.3 percent year-over-year, up from a 2.2 percent year-over-year increase a year ago.