MISMO®, the real estate finance industry standards organization, seeks public comment on its new implementation guide specification that helps facilitate obtaining estimated mortgage insurance rate quotes in the JavaScript Object Notation API format.

Category: News and Trends

Quote

“The increase in rates triggered the fifth straight decrease in refinance activity to the slowest weekly pace since January 2020. Higher rates continue to reduce borrowers’ incentive to refinance.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

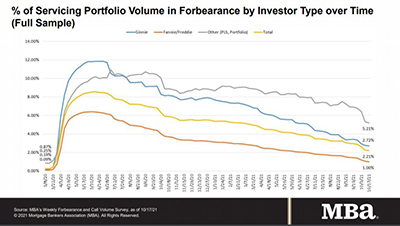

Share of Mortgage Loans in Forbearance Decreases to 2.21%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 7 basis points to 2.21% of servicers’ portfolio volume as of October 17 from 2.28% the week before. MBA estimates 1.1 million homeowners are in forbearance plans.

Wuthering Heights: Rent Control Proposals Make the Rounds

Many would agree that commercial real estate has not had a classic economic downturn since the Great Recession. That is important to consider in business planning generally, and specifically as apartment rents increase across the country.

MBA Premier Member Profile: FormFree

FormFree® is a fintech company whose revolutionary products AccountChek® and Passport™ are building a more inclusive credit decisioning landscape by encouraging lenders to view borrower ability to pay (ATP) more holistically.

Ask an Analyst: Talking About ESG & CRE Implications With Paul Fiorilla

Paul Fiorilla is Director of Research at Yardi Matrix. His research covers all facets of commercial real estate and he recently published a report highlighting different environmental risk levels across metro areas in the U.S. MBA Newslink interviewed him about the implications of recent environmental, social and governance trends.

Mark P. Dangelo: 2022 C-Suite Agendas Meet New Realities

The challenges of the executing against traditional business prescriptions are many—at a minimum due to changes in strategy, personnel, convention, ecosystems, innovations, and cloud (maturity). The accepted top-down agenda setting management theory of academics and consultants constructed in silos of efficiency are being called into question.

Chris Meade of LenderClose: The Right Stuff–How the Right Technology Can Unlock Real Estate and Home Equity Lending

Chris Meade is Vice President of Client Relations of LenderClose, a fintech engaged in providing technology platforms to home equity and real estate lenders. With more than 10 years of experience in the technology industry, he seeks to build and enrich client relationships with a personable and user-centric approach.

MBA Submits Comments on FHFA Proposed GSE 2022-2024 Housing Goals

The Mortgage Bankers Association on Monday submitted comments to the Federal Housing Finance Agency on its proposed rule for 2022-2024 housing goals for Fannie Mae and Freddie Mac.

Hotel Construction Pipeline Optimistic

The U.S. hotel construction pipeline fell compared to a year ago, but look a little further ahead and you’ll see signs of optimism among hotel developers.