Pretium, New York, a specialized investment management firm with $30 billion in assets, acquired Anchor Loans LP, a provider of financing to residential real estate investors and entrepreneurs

Category: News and Trends

Quote

“With employers struggling to fill millions of open positions, wages are rising, with average hourly earnings up almost 5% compared to last year. Strong wage growth should be effective in continuing to bring individuals who had stopped looking for work back into the labor force, but the participation rate remains below pre-pandemic levels.”

–MBA Chief Economist Mike Fratantoni.

Making Affordability A Priority: A Discussion with MBA’s Katelynn Harris Walker

MBA Newslink interviewed Katelynn Harris Walker, Associate Director of Affordable Housing Initiatives for the Mortgage Bankers Association, where she is dedicated full time to advocacy and engagement on affordability.

Tom Lamalfa: October 2021 MBA Annual Convention & Expo Survey

In early October I surveyed 34 senior executives from 34 separate mortgage companies about an array of issues and topics both relevant and consequential to the mortgage banking industry. It was the 26th time since 2008 that this survey has been conducted and published by the MBA.

Timothy Raty of Mortgage Cadence: USDA and the GSEs’ New Uniform Security Instruments

While Rural Development’s requirements lack details specific to the content of the security instruments used, they do have plenty of other requirements regarding the servicing of a loan which may not be completely compatible with the covenants within the SIs. The following summarizes the types of conflicts, additional requirements and near conflicts that may exist

Jennifer Henry of Equifax: Accelerating Access to Credit for Marginalized Communities Can Provide Benefits on a National Scale

While there are more tools, technology advancements, access to data and specific programs tailored to minority consumers and marginalized groups than ever before, there are still additional steps the industry can take to truly make homeownership a reality for all.

Auction.com: Completed 3Q Foreclosure Auctions Up 16%

Auction.com, Irvine, Calif., said completed foreclosure auctions in the third quarter increased by 16 percent from the previous quarter and by 89 percent from a year ago to a new pandemic high.

Housing Market Roundup Nov. 5, 2021: Home Prices Ramp Up; Pressure on Margins; More Affordable Homes Available

Another end to the week; another flurry of economic and housing reports. Here’s a quick summary of what’s come across the MBA NewsLink desk:

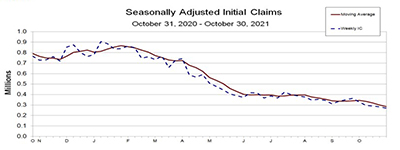

Initial Claims Down Another 14,000 to New Post-Pandemic Low; S&P Sees Structural Shift in Workforce

Initial claims for unemployment insurance fell by 14,000 last week and are now less than 15,000 per week away from pre-coronavirus pandemic lows, the Labor Department reported Thursday.

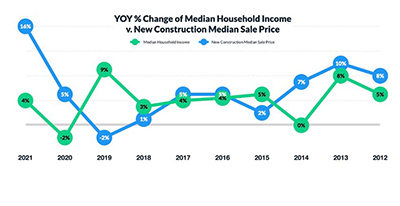

Most Americans Cannot Afford a New Construction Home

A new analysis by Knock, New York, a digital homeownership platform, reported most American households are being priced out of the new home market even as builders shift their focus to smaller homes to accommodate the entry-level market.